Picture Supply: Getty Photos

Take into account Barclays (LSE: BARC) Inventory costs symbolize the worth of cash. I believe it is clever to match it to different banks. Luckily, London Inventory Change We commonly publish knowledge that makes this doable.

Numbers

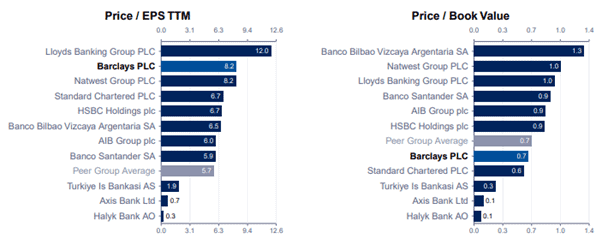

Based mostly on outcomes over the previous 12 months, Barclays’ value and return charge is 8.2. of FTSE 1005 banks, which is able to place third within the league’s “low cost” desk.

Wanting on the steadiness sheet, the price-to-book ratio is 0.7, which means that the worth of the asset (low legal responsibility) is 30% decrease than the present (July 18th) inventory market valuation. Right here it’s higher than all of its friends Commonplace Constitution.

Revenue traders can have a look at dividend yields and see what earnings they make. Whereas there isn’t any assure relating to funds, Barclays’ yields are decrease than all Footsea banks, besides that it’s a customary constitution.

So, with such an advanced image, the place does this depart us?

What now?

We had been in a position to have a look at the dealer’s 12-month value goal and see what they assume. After all, these are simply predictions, however a median of 382.5p signifies that Barclays inventory is at present undervalued by 10%.

Inspired, nobody would suggest that shoppers promote their shares.

FTSE 100 banks solely Natwest Group It is higher with an underestimation of practically 17%.

The truth is, brokers assume that customary chartered shares are too 9% increased. HSBCIt is fairly price it, Lloyd’s Banking GroupThe present market capitalization is 5% decrease than its true worth.

See the tree for the tree

Given this complicated background, I believe it is time to take a extra subjective view somewhat than utterly counting on numbers.

In my view, you’ll all the time want a financial institution. All new issues on the scene are comparatively small, and none of them are near threatening the UK’s “Huge 5” rule.

However that does not imply the trade will not face that problem. Over time there have been many financial institution crises and a few notable collapses. Many needed to reinforce their steadiness sheets to proceed to satisfy regulatory necessities.

Sector revenues may be risky. Dangerous loans are a selected difficulty throughout a recession.

Nevertheless, I believe the UK banking trade, particularly Barclays, is in good situation.

The Financial institution of England’s newest monetary stability report contains the sector’s “It maintains a well-capitalized, sturdy liquidity and funding place, and the standard of its belongings stays robust.”

Relating to Barclays, the outcomes for the primary quarter 2025 confirmed a 26% improve in earnings per share in comparison with a 12 months in the past. By the top of 2026, it plans to extend its revenue margin on tangible shares to over 12%. In 2024, it was 10.5%. With over £50 billion in inventory, a 1.5 proportion factors enchancment has a significant impression.

Actually, this isn’t sure. However with skilled bosses, robust manufacturers and sturdy steadiness sheets, I believe we will obtain this objective. Due to this fact, I plan to carry the inventory. Different traders also can take into account including shares to their portfolio.