Picture supply: Getty Photos

of blood strain (LSE: BP.) share value has rebounded strongly after hitting a three-year low in April. The third quarter outcomes introduced at this time (November 4th) present indicators of additional enchancment, and I believe traders are beginning to regain confidence within the firm’s future prospects.

Third quarter numbers

BP reported underlying substitute value advantage of $2.2 billion, down roughly $200 million from the prior quarter. This lower was primarily resulting from greater tax charges.

The corporate’s refining division delivered an impressive efficiency, posting a revenue of roughly $100 million. This energy was pushed by improved refining margins and the bottom stage of reclamation exercise previously 20 years.

In distinction, oil buying and selling was weak throughout the quarter, whereas manufacturing and operations had been roughly flat.

However BP’s undertaking pipeline seems notably robust. In Kirkuk, the Iraqi authorities has activated a contract to rehabilitate the area’s huge oil fields.

To date in 2025, BP has made 12 new discoveries. The spotlight is Bumerangue in Brazil, the largest discovery in 25 years. Preliminary checks have proven a complete hydrocarbon column of 1,000 meters, indicating nice long-term potential.

dividend star

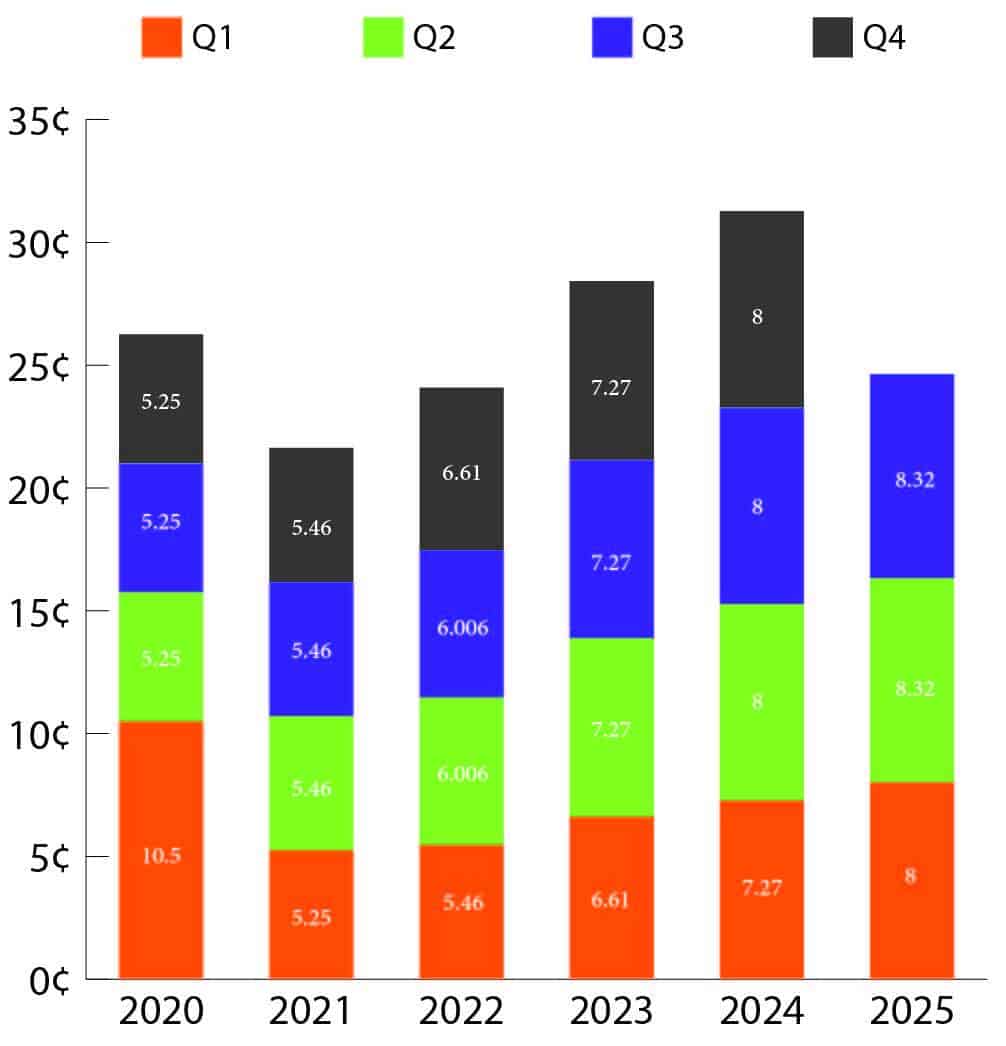

The oil main stored its dividend unchanged at 8.25 cents per share, giving it a future dividend yield of 5.6%. Dividends are nonetheless 22% decrease than in 2019. Nevertheless, because the graph under exhibits, it has been steadily rebuilt lately. This exhibits that confidence in money technology is growing.

Graph created by the writer

The important thing problem now’s dividend sustainability. Final 12 months, the corporate earned simply 2.38 cents a share. That is nicely under the extent wanted to cowl the dividend. Nevertheless, for capital-intensive industries, cash-based measures present a clearer image of economic energy. Taking this into consideration, the corporate’s place seems to be even stronger.

Final 12 months’s working money stream was greater than 5 occasions the dividend, and the identical sample applies when free money stream. Since 2021, dividends have persistently consumed lower than half of free money stream. This clearly exhibits that regardless of fluctuations in earnings, the dividend stays nicely supported by money technology.

oil mispricing

The oil market is present process irregular actions. Regardless of robust help from the US authorities, costs are about 20% decrease than final November. Investor curiosity in oil is muted and bearish sentiment prevails. This situation has traditionally introduced alternatives, as we noticed with gold a number of years in the past.

Costs have been hovering round $60 for a while, a stage that appears unsustainable. Many small producers in the US are working under break-even, and manufacturing might quickly peak and decline.

The stress on the trade is evident. Over the previous two years, the variety of rigs within the Permian Basin has declined by 30%. Effectivity positive factors clarify a few of this decline, however are unlikely to account for such a pointy decline in such a brief time frame.

Persistent low costs are weighing on commodity producers, and layoffs have gotten more and more widespread. BP itself has already introduced 1000’s of job cuts.

conclusion

Regardless of unfavourable sentiment throughout the trade, I imagine oil costs will rise over the following 12-24 months. With bettering fundamentals, I see BP as one of many key beneficiaries. So we proceed so as to add positions as funds enable.