Picture Supply: Getty Pictures

State pension information hardly ever escapes headlines. Each spotlight the significance of long-term monetary planning utilizing pensions and financial savings merchandise comparable to particular person financial savings accounts (ISAs), quite than assumptions about future residing requirements for retirees.

The UK will not be solely going through a retirement disaster. Mixed with an getting old inhabitants, the deteriorating fiscal scenario raises questions on how governments all over the world can fund future pensions.

That is a relaxed concept. Nevertheless, it’s by no means too late to start out constructing wealth to keep away from the financial hardships of later years. Allow us to present you the way diversified funds may also help you shield your monetary future.

Watch out for warnings

Feedback from the UK authorities on Monday (July 21) spotlight the sturdy time bombs going through Britons at the moment.

In accordance with a examine by the Ministry of Labor and Pensions (DWP) that individuals who retire in 2050 are 8% (£800) than those that are withdrawing their workforce at the moment.

He stated the federal government will reinstate the Pension Committee to cope with the disaster.Analyzing complicated obstacles to cease folks from being saved sufficient for retirement“However that is not all – its function isLook by means of all the pension system and see what it takes to construct a robust, truthful and sustainable future prevention pension system“.

Along with this, one other authorities evaluate analyzes the age at which individuals can start to assert state pensions.

The present pension age of 66 is predicted to rise to 67 between 2026 and 2028 and to 68 between 2044 and 2046.

Goal passive earnings of £44,000

I do not know you. However I do not need to put myself in mercy that may change authorities insurance policies. I need to retire at an honest age and luxuriate in a snug way of life once I do.

My plan is to construct my very own retirement fund with money, shares, trusts and funds utilizing numerous ISAs and self-investment private pensions (SIPPs). By prioritizing investing within the inventory market, we imagine that we will obtain a long-term common annual return charge of 8% whereas successfully managing threat.

With that return, a month-to-month funding of simply £500 over 30 years produces £745,180 of the retirement nest eggs. At this degree, should you spend money on 6% of your employable dividend inventory, you’ll take pleasure in a passive earnings of £44,711 per yr for retirement.

And it excludes doable help from the state pension.

Wealth Constructing Fund

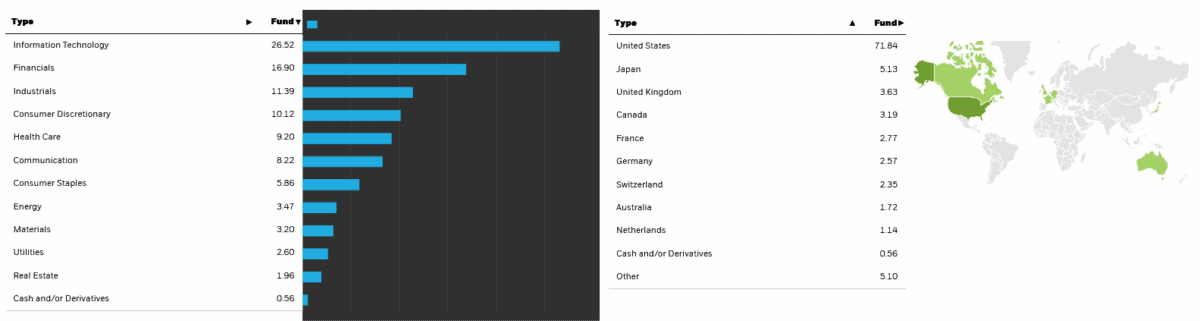

World funds like iShares Core MSCI World Index (LSE:IWDG) It will likely be a strong weapon that may make it easier to obtain this. Diversification throughout areas and sectors doesn’t undermine alternatives to make life-changing returns, however gives glorious threat administration.

In actual fact, since its inception in 2017, the Change-Traded Fund (ETF) has had a median annual return charge of 10.9%.

Such stock-based automobiles can convey disappointing returns throughout market hunch. Nevertheless, as this Isshares Fund reveals, over the long run, they will successfully harness the potential of the inventory market and produce about nice earnings. Listed here are the main holdings nvidia, Amazonand Berkshire Hathaway. In complete, it holds shares in 1,324 world shares.

With its sturdy development sectors like IT and monetary companies, I believe the fund might proceed to be an awesome asset builder. That is one in every of some funds I believe would require severe consideration.