Picture supply: Rolls-Royce plc

of rolls royce (LSE:RR)’s share value has seen a powerful rise this yr. Consequently, somebody who invested £1,000 within the inventory 5 years in the past would now have an funding price £9,868.

Analysts’ 2026 inventory value targets recommend one other sturdy yr for the worldwide economic system. FTSE100model of Nvidia It is perhaps on the cardboard. So, is there nonetheless a chance to purchase although the inventory is up 889%?

Analyst predictions

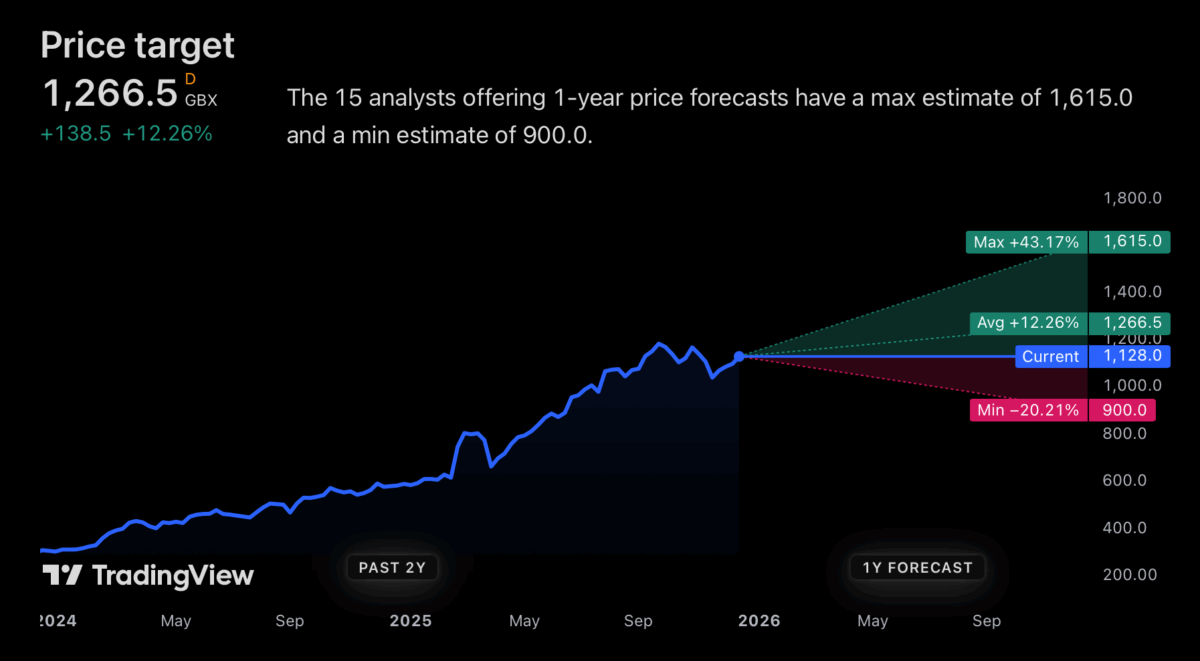

The typical analyst value goal is presently about 12% increased than present ranges. That is greater than the typical FTSE 100.

If issues go nicely, there’s motive to assume Rolls-Royce’s share value may rise additional. The very best estimate is simply over £16, which is 43% above the worth the inventory is presently buying and selling at.

The corporate’s price-to-earnings ratio (P/E) is 16 instances, which incorporates one-time earnings boosts that will not be repeated. Adjusting these will increase the magnification to just about 35x. Which means some issues have to be proper for the corporate and they don’t seem to be assured. And that implies that excessive multiples for inventory costs heading into 2026 are a threat.

air journey

Lately, the most important driver of Rolls-Royce’s progress has been industrial aviation. Demand for air journey is robust and can proceed to be so in 2026. After all, there are at all times dangers on this business. Recessions can come out of nowhere and when companies least count on them, and might have a significant affect.

Current financial development has been comparatively weak, which means a cyclical recession is an actual risk. Excessive fastened prices additionally imply earnings can shrink rapidly.

However importantly, Rolls-Royce has not too long ago been on the middle of some essential long-term traits. Subsequently, even when air journey demand slumps, there should be room for positivity.

protection and energy

The 2 largest themes for 2025 are protection and synthetic intelligence (AI). These are each areas wherein Rolls-Royce is instantly or not directly concerned.

NATO’s dedication to extend protection spending ought to enhance demand for plane, submarines and ships. And that’s more likely to lead to elevated demand for the corporate’s engines.

From an AI perspective, the information facilities that main expertise corporations are constructing require dependable backup energy. Rolls-Royce additionally affords each generator and battery options.

Importantly, each of those sectors ought to develop revenues nicely past 2026. Subsequently, these are additionally essential causes to be constructive on the inventory over the long run.

long run funding

I am a little bit hesitant about Rolls-Royce inventory subsequent yr. Something can occur within the firm’s industrial aerospace division, and the inventory may soar in both route.

From a long-term perspective, issues look a bit extra constructive, with the corporate uncovered to a number of key development industries. Meaning buyers could need to contemplate.

Nonetheless, my sense is that that is unlikely to be one of the best FTSE 100 inventory to purchase in the mean time. There’s quite a lot of momentum, however I feel there could also be alternatives to discover extra.