Picture supply: Getty Photos

of Lloyds Banking Group (LSE:LLOY) share value rose from 55.04p to 97p in 2025. However the subsequent query for buyers is how excessive the inventory can go in 2026.

If there’s a related transfer subsequent yr, the share value may attain £1.30. Rates of interest could fall, however there are nonetheless causes for buyers to be optimistic.

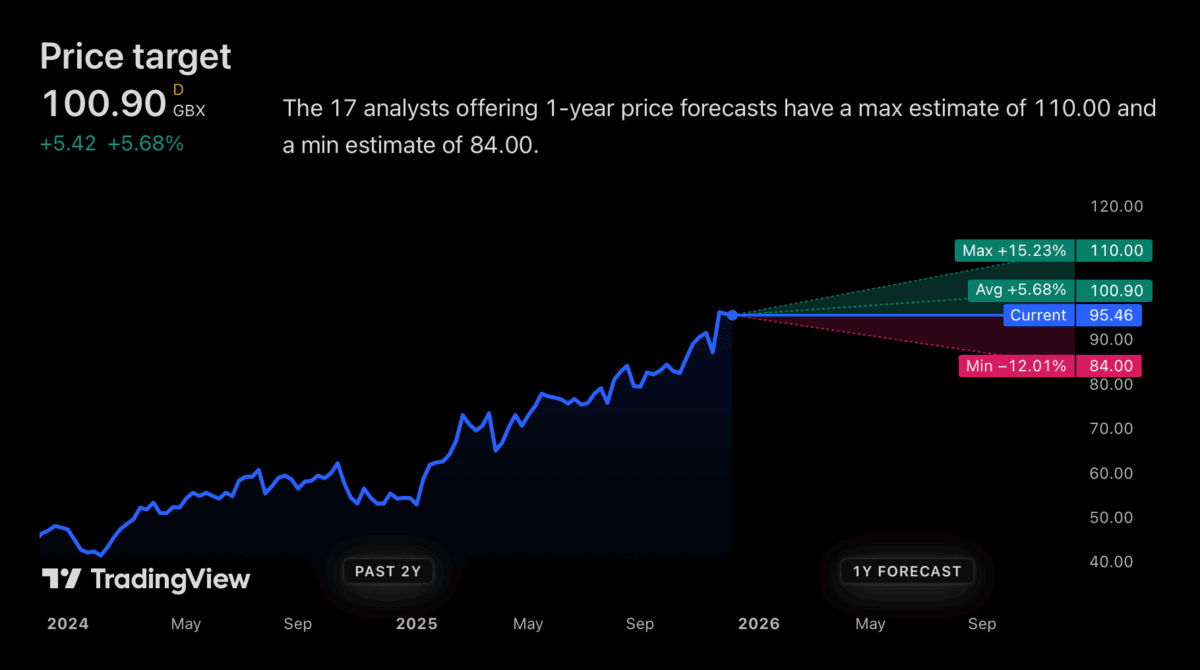

value goal

For my part, the analyst neighborhood doesn’t count on Lloyds to carry out once more in 2026. The best value goal is round £1.10, 16% above present ranges..

That is not a nasty end result in any respect – it far exceeds the aim FTSE100 common. Nonetheless, a much less optimistic forecast requires the inventory to fall by as a lot as 12%.

There’s good cause to assume 2026 will not be a really sturdy yr for shares. The obvious is the potential for rates of interest to fall, which may impression mortgage margins.

However regardless of this, there are causes for optimism. For a financial institution the scale of Lloyds, it isn’t so simple as chopping rates of interest and decreasing income for the corporate.

structural hedge

Like many banks, Lloyds makes use of what is named structural hedging. It’s mainly a mix of a protracted length fastened charge asset (corresponding to a bond) and an rate of interest swap.

These assist defend banks within the brief time period if rates of interest fall. In different phrases, decrease rates of interest in 2026 mustn’t imply a direct decline in company revenue.

In truth, decrease rates of interest may enhance revenue margins in 2026. If banks can shortly decrease financial savings charges whereas mortgage charges stay fastened, lending income may very well be boosted.

Greater rates of interest are more likely to profit Lloyds within the medium time period. Nonetheless, I do not assume buyers ought to assume that the 2026 cuts will instantly reverse the corporate’s earnings.

guidelines

Waiting for 2026, Lloyds shareholders have much more cause to be optimistic. One is the chance that rules will probably be eased, giving banks extra room to lend.

For the primary time in 10 years, the Financial institution of England has determined to scale back the quantity of Tier 1 capital that UK banks are required to carry. It’s scheduled to be launched from January 2027.

That would depart Lloyds and others with surplus capital that may very well be used to develop lending services. Nonetheless, please observe that this is applicable to all banks, so competitors could improve.

Banks usually keep capital adequacy ratios properly above statutory necessities, however decrease requirements give them extra room to lend. And this might contribute to revenue progress from 2026 onwards.

do not be too hasty

Lloyds has been among the best FTSE 100 shares to personal in recent times. This contains cyclical results, however buyers should not write off this too quickly in 2026.

Declining rates of interest are more likely to be a problem. However that is the type of factor that banks must be ready to take care of, and that structural hedging suggests that’s the case.

Wanting additional forward, there’s cause to assume this inventory may very well be a superb funding past 2026. However as the brand new yr approaches, that is not my greatest probability.