Picture Supply: Getty Photos

I believe these UK shares are nice choices to contemplate whether or not traders are in search of sturdy secondary earnings. That is why.

Platinum Play

Gold shares aren’t the one sport on the town for traders who wish to result in hovering earlier metallic costs. Buy of shares in Platinum Group Steel (PGM) producers is one other potential play as costs right here additionally take off.

Gold costs rose 45% final yr. In the meantime, Platinum rose 47% over that interval. And because the metallic provide drops, even higher income may very well be achieved.

In keeping with the World Platinum Funding Council, complete platinum provide will fall to a five-year low in 2025. With rising demand for jewellery and funding returns, the group expects the market to hit a deficit of 850,000 ounces this yr.

Buy platinum shares like Sylvanian Platinum (LSE: SLP) is a extra worthwhile strategy to benefit from larger metallic costs than bodily metals and metallic monitoring funds. This South African miner’s share worth rise of 75% final yr demonstrates this principle.

Miners benefit from the “leverage” impact. There, revenues rise with product costs, however prices are largely steady. This might lead to Sylvania, a rise in EBITDA of 118% year-on-year, to over-profit, as proven within the enhance in final fiscal yr (till June 2025).

Please word that the “leverage” issue can imply that income might be dipped if metallic costs are reversed. Nonetheless, for now, I believe this phenomenon ought to proceed to work with the corporate’s favor.

Metropolis analysts share my optimism and anticipate income to nearly double in 2026 in Finance. The forecast is boosted by a company plan to extend year-round platinum, palladium, rhodium and gold, from 83,000 to 86,000 ounces from final yr’s report.

This additionally means brokers anticipate their annual dividend to surge to round 4p per share this yr, from 2.75p final yr. So Sylvanian Platinum carries a wholesome 5.2% dividend yield.

FTSE 100 Favorites

BAE System (LSE: BA.) Such a excessive dividend yield just isn’t supplied within the brief time period. In 2025 and 2026, will probably be 1.8% and a couple of% respectively.

However the prospects for dividend progress that builds extra markets nonetheless produce this FTSE 100 Shares value critical consideration.

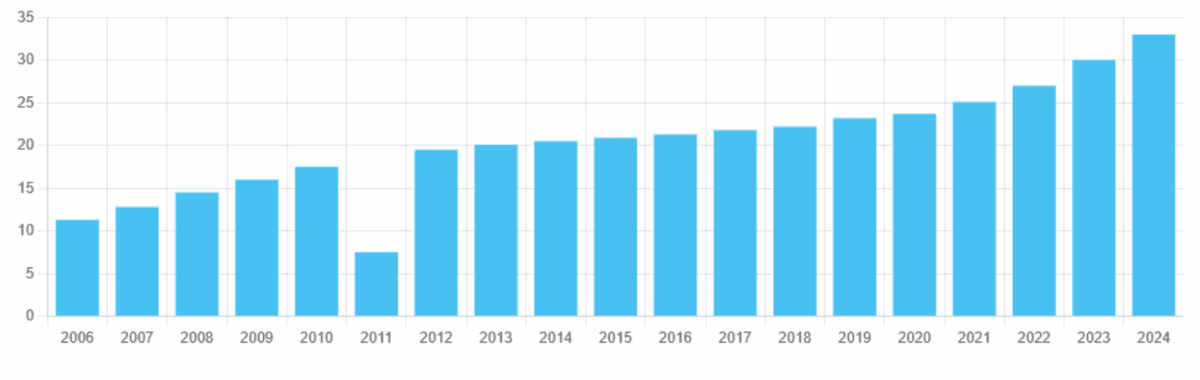

Shareholder funds have elevated annually since 2012, leading to a dividend of 33 penns per share final yr. And metropolis brokers anticipate them to lift one thing else:

- 8% in 2025, 35.7p.

- 10% for 2026, 39.4 pages.

Taking a look at all this from a perspective, the dividend progress throughout the UK’s broader share index averaged between 3% and 4% this century.

This doesn’t make it a simple stock for the BAE system to buy. As a significant provider of the Division of Protection, its profitability is uncovered to one thing that brings again US navy exercise on the world stage.

Nonetheless, this isn’t a kind because the geopolitical panorama continues to evolve. Furthermore, the corporate can anticipate gross sales to proceed to extend to different key prospects, together with the UK, Australia and Saudi Arabia governments. Sturdy spending from NATO and accomplice international locations elevated group gross sales by 11% within the first half.

This inspired the BAE to lift its earlier yr’s provisional dividend by 9% per yr. I hope that the dividend will proceed to march larger because the Western recontracts are being tilted to proceed.