Picture supply: Getty Photos

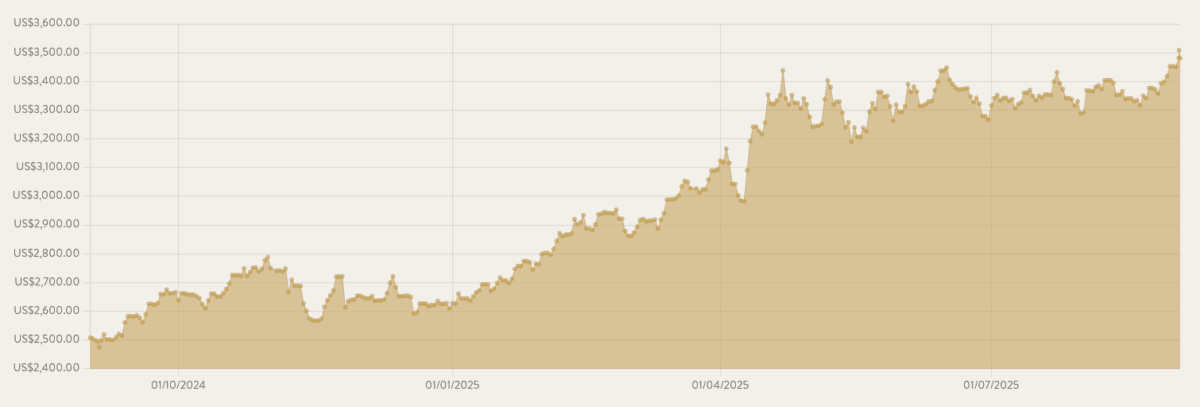

Gold costs have surged as soon as once more, reaching a brand new file excessive of over $3,509 per ounce on Tuesday (September 2). Gold shares and change commerce funds (ETFs) returned to the invoice after falling in triggering an earlier peak in April.

Yellow metallic’s newest upside is pushed by hypothesis concerning the Federal Reserve’s rate of interest cuts and the US Central Financial institution’s future independence. Additional earnings are extensively anticipated – jpmorgan Gold costs have averaged $3,675 by the fourth quarter and $4,000 by mid-2026.

The indicators look nice on gold shares and capital, however after all we can’t assure additional worth will increase. There are three issues to think about within the present market.

Straightforward route

The simplest means is to purchase an ETF that owns bodily gold (on this case, a bar trapped in a vault). This protects the issue that buyers need to retailer and promote the metallic itself. It additionally eliminates the necessity to purchase gold-producing shares to be uncovered to treasured metals.

Ishares Bodily Gold (LSE: SGLN) is one thing I feel requires critical consideration. It’s the UK’s largest monetary fund, with complete belongings exceeding $18.7 billion and enjoys distinctive liquidity, making it simpler for buyers to open positions and shut.

Moreover, its complete value ratio is a really enticing 0.12%. solely Xtrackers Bodily Gold The fund’s prices are low (0.11%).

Nevertheless, do not forget that if gold reverses the course, the worth can fall naturally.

Low-cost gold inventory

As I say, people can benefit from buoyant gold costs by bearing in mind the shares of metallic producers. Brazilian Miner Gold Pancakes (LSE:SRB) is one thing that catches my eye.

Holding gold shares is extra dangerous than bodily metallic or bullion-backed ETFs. If gold costs drop, it might drop if operational points come up. For instance, Serabi might retrace if there’s a double drive to manufacturing within the coming years.

Nevertheless, this technique might imply greater returns, as producer earnings might skyrocket way more than gold costs in bull markets. Moreover, holding gold shares also can present a further bonus of dividend earnings. The dividend yield on Serabi is a stable 3.8%.

Right this moment, shares commerce at a constructive worth (P/E) ratio of three.9 instances. In my opinion, this inexpensiveness presents a major vary of worth will increase.

Finest in each worlds

There are apparent benefits and drawbacks to purchasing gold monitoring funds and bullion-producing shares. I feel one enticing method to stability the danger and rewards of each choices is to search for ETFs fairly than holding shares in many various gold corporations.

This can be a technique that truly selected myself by buying an L&G Gold Mining ETF (LSE: AUCP). The fund holds stakes in 37 totally different gold corporations, which helps scale back the impression of shocks skilled by particular person corporations on shareholder returns. However after all, it doesn’t rule out these dangers.

I like this explicit fund. Newmont Mining and Anglogold Ashanti. These companies are typically way more secure than junior miners, however provide vital capital good points potential.

It offered an 80.6% return over the past 12 months. That is considerably higher than the 38.9% enhance that gold costs have loved over the interval.