Picture Supply: Getty Pictures

FTSE 100In my view, it is without doubt one of the greatest locations to purchase passive revenue shares. The UK Blue Chip Share Index is full of shares which have a sturdy stability sheet, market-leading positions and numerous income streams that make them wonderful candidates for long-term dividend income.

Footsy loved sturdy advantages final 12 months. This decreased the index’s ahead dividend yield to three.2%. It’s on the backside of the long-term common investor of 3-4%.

But it surely’s a lot increased than different world shared indexes. Moreover, buyers can get a lot increased yields than this by deciding on particular person shares of selection.

Right here we present you the way buyers can earn passive revenue of £1,000 a month with a portfolio of dividend shares registered on FTSE.

5 star portfolio

At present, a few of the FTSE 100’s highest dividend shares function within the Monetary Providers sector. The three I am selecting for our miniportfolio are Authorized & Common (LSE: LGEN), Phoenix Group and Aviva.

Authorized & Common inventory at present provides the best dividend yield on this group at 9%. Phoenix heats the heels with an 8.5% yield. Aviva is low however nonetheless serves 5.5% tasty.

Every of those companies is a market chief, producing a considerable amount of money that may be distributed to shareholders. It additionally has wonderful long-term development potential because it drives demand for merchandise as a consequence of ageing and elevated involvement in monetary planning.

The dividend portfolio of different corporations 5 shares is a packaging producer. world – Defensive sharing with what you get from the e-commerce increase Nationwide Grid. These shares deliver 6.1% and 5.5% respectively.

Heroic efficiency

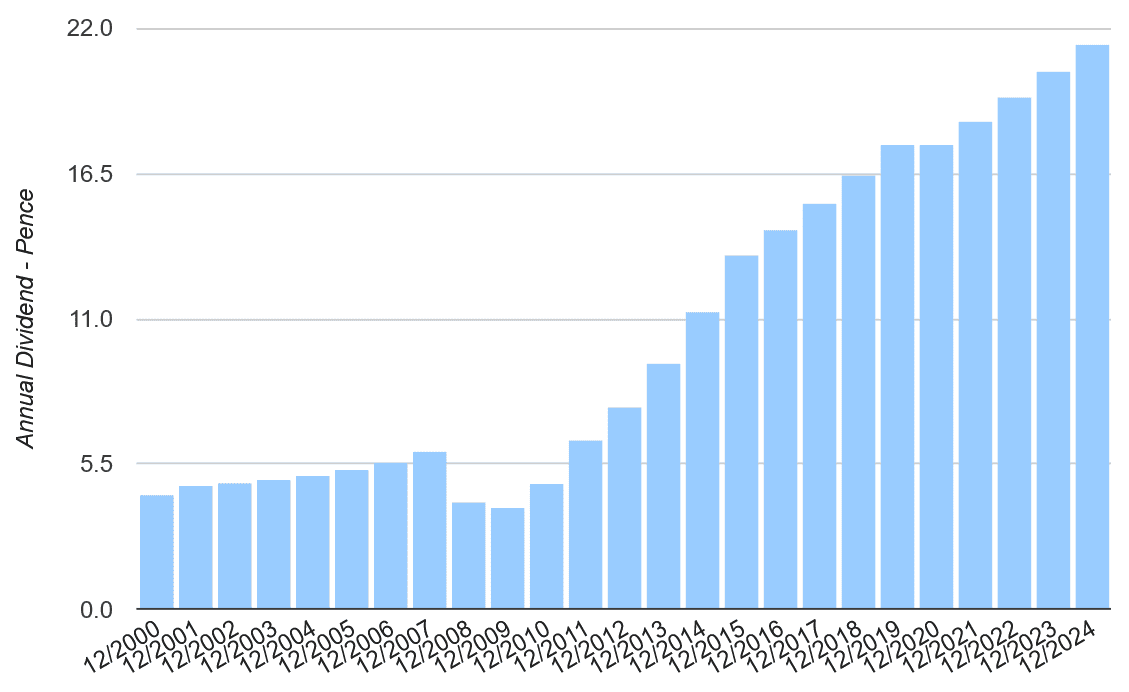

In my opinion, Authorized & Common is without doubt one of the true dividend heroes of the FTSE 100. And it isn’t simply due to its big, virtually double-digit dividend yield.

Because the huge cash disaster, we’ve got been accumulating dividends virtually yearly. The one exception was when dividends have been frozen in 2020 throughout the pandemic. And even so, it carried out higher than many different blue chips that decreased or canceled dividends.

Like different monetary service suppliers, revenues are extremely delicate to the broader financial scenario. And now, as inflation rises and the financial system splashes out, the outlook stays unsure.

However inspired, Authorized & Common has demonstrated resilience on this setting, with underlying working revenue rising 6% within the first half, serving to us survive volatility and proceed to pay our giant, rising dividends. The Solvency II ratio was 217% as of June.

High FTSE Portfolio

In fact, there are threats going through every of the 5 dividend shares I’ve chosen. Dividends at Aviva and Phoenix might be disappointing when shopper spending weakens. Each they and Mondi are susceptible to commerce tariffs. Dividends on the Nationwide Grid might be topic to strain within the case of capital expenditure balloons.

Nonetheless, I nonetheless assume that dividend yields of a mean of 6.9% is price contemplating this miniportfolio. This might generate £1,000 month-to-month passive revenue, as it’s a £174,000 fund with an quantity equal to 5 shares invested.

That is not a small quantity. Nonetheless, we assume that this purpose might be achieved with a month-to-month funding of £500 over 15 years, with a mean annual return of 8%.