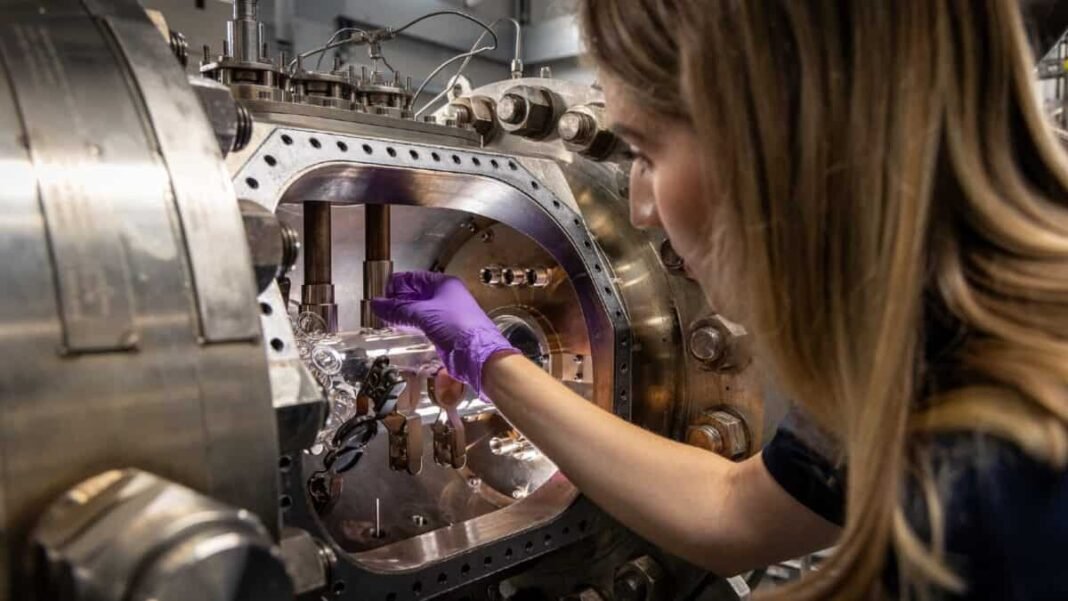

Picture supply: Rolls-Royce plc

it will possibly’t be denied rolls royce (LSE:RR.) Shares are the primary driver FTSE100 progress over the previous few years. Inventory costs have gone parabolic, persevering with to rise regardless of rising considerations a couple of correction.

However here is a thriller that is waking up sensible buyers. Regardless of hovering 111% over the previous yr, income grew eight occasions quicker than the inventory value. On the floor, this sounds nice. Which means firms are making earnings whereas costs are lagging. Nonetheless, in the event you dig deeper, you can see {that a} barely extra advanced scenario is unfolding.

In my view, the numbers inform conflicting tales. Underlying working revenue and money movement is predicted to exceed £25bn in FY2019, with engine flight hours recovering to 109% of pre-pandemic 2019 ranges. In the meantime, earnings per share (EPS) almost doubled within the second half of 2012, so there isn’t any doubting the corporate’s distinctive efficiency lately.

So why fear?

That is the place it will get uncomfortable. These spectacular positive factors are at the moment mirrored in a ahead price-to-earnings ratio (P/E) of 41.7x, almost 3 times the corporate’s historic common. The typical 12-month value goal is simply 7.8% above the present value, which is extraordinarily low for a inventory that has risen 111% in a single yr. Traders seem like pricing in a restoration, however there could also be little left to shock them.

For buyers accustomed to life after retirement FTSE100 Dividend shares yield between 5% and seven%, however Rolls-Royce gives virtually nothing. The present dividend yield is simply 0.87%, and is predicted to rise to 10.6p per share in 2026 and 12p in 2027. Even at these excessive ranges, yields barely exceed 0.8% to 1%. To generate significant earnings, you would wish to carry a large place, which appears dangerous given the present valuation.

Then there’s the problem of £4.9bn in debt in comparison with £2.4bn in fairness. Regardless of a web money place of £1bn, its debt burden stays excessive. Its plan to hold out a £1bn share buyback by the tip of 2026 might be optimistic given the valuation dangers going ahead.

So what’s that play?

Overvaluation and debt could also be on my thoughts all day lengthy, however that does not imply Rolls’ share value will not proceed to rise. Sturdy money flows, a stacked order e book, and strong market sentiment are sufficient to help a continued upward trajectory.

However the longer this goes on, the longer costs will stay balanced on more and more fragile foundations. This isn’t the fault of the enterprise itself, however merely the legal guidelines of financial sustainability. Traders are understandably involved after the inventory has fallen 7% previously two weeks (the third time this has occurred in a yr).

So for these keen to threat a long-term progress story, Rolls remains to be value contemplating. However for value-oriented, risk-averse buyers like me, it is not interesting.

Happily, the FTSE 100 is filled with high-quality, low-priced choices which are poised for distinctive progress in 2026. For buyers searching for steady returns with out excessive valuation threat, chill out, Experianand London Inventory Alternate Group It is value taking a more in-depth look now.

Whether or not you select earnings stability or high-risk/high-return progress, it is at all times helpful to take care of a broadly diversified portfolio. Constructing a portfolio with a wide range of shares from completely different sectors and geographic areas can scale back threat whereas concentrating on combine and market alternatives.