Bloomberg /Contributor /Getty Photos

The forecast market is a gorgeous method to leverage professional data and helps to publish insights that would in any other case stay personal. These markets present monetary incentives to consultants to make data public. Cryptocurrency. Nevertheless, they don’t seem to be with out their drawbacks, as forecast markets usually seem like playing and will be uncovered to types of market exploitation.

Here is why forecast markets are gaining popularity and buyers ought to concentrate on:

How does the forecast market work?

A wide range of forecast markets have emerged lately as sizzling cash, actual consultants and gamblers compete for locations the place there’s motion. Forecast markets use what is known as occasion contracts to create markets for real-world occasions, resembling elections, sports activities contests, inventory indexes and cryptocurrency costs at a specific time. 1000’s of contracts can go on without delay. This presents a whole lot of motion to cussed gamblers.

Occasion contracts are organized as YES/NO bets. One facet is right and will get the payout, whereas the opposite facet loses by mistake. Subsequently, the occasion contract ought to be arrange so there isn’t any intermediate floor. Occasion contracts are a kind Binary Choicesjust one facet is right. On the finish of the occasion, the guess contract shall be resolved between the counterparties.

For instance, the forecast market could have the next ideas:

When you suppose that Bitcoin will exceed this worth by this time, you should purchase a YES share for 14 cents. When you suppose Bitcoin hasn’t reached its goal worth, you should purchase NO share for 89 cents. In both case, whether it is right, you may be paid one greenback.

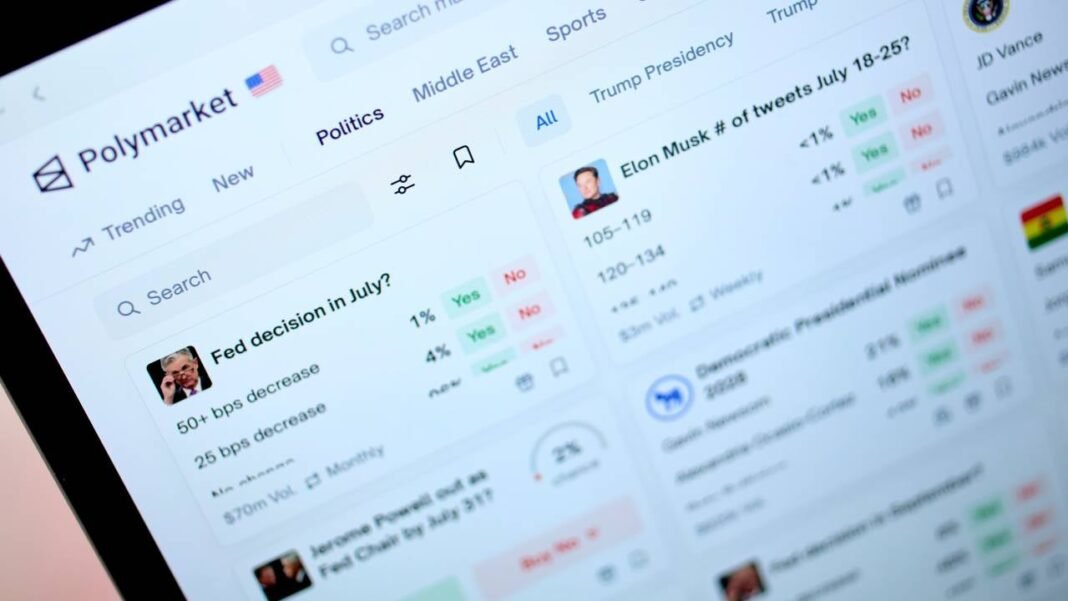

Giant names for forecast markets embody Polymarket, Predictit and Kalshi. They provide bets on politics, sports activities, worldwide politics, tradition and different areas. What number of tweets does Elon Musk wish to wager in a specific week? You are able to do it there.

brokers resembling Robin Hood and Interactive dealer In addition they supply occasion contracts, however the scope of occasions is extra targeted, together with financial and monetary occasions and sports activities.

Why the forecast market is value it

The forecasting market will be notably attention-grabbing as a forecasting device, and in its greatest type, it could actually present true social worth by publishing the potential outcomes of the occasion. This information is made public because the forecast market provides consultants monetary incentives to specific an knowledgeable opinion on the result of the occasion. For instance, these with an in depth understanding of election outcomes and geopolitical occasions can specific their opinions and place bets by the forecast market. Their data is printed and gives a broader understanding of the occasion.

In fact, many occasion agreements are all about every thing besides worthless data. For instance, the preferred offers have at all times been stakes on the latest trending listing of “Mrbeast raises $40 million for Clear Water by August thirty first?” and “Is Earth Flat?” and naturally, how prolific Elon Musk’s tweet recreation is.

What are the benefits and drawbacks of the forecast market?

The forecast market poses a whole lot of danger to buyers, not solely to the character of the occasion contract, but in addition to the market itself.

The Advantages of the Forecast Market

- In any other case, we are going to publish your private data: The forecast market can help with hidden or professional data on the floor, which might present priceless data to a variety of audiences.

- Chance of spending your cash: Occasion contracts could make some huge cash. Particularly when sudden data is discovered to be right. The extra your right data and opinions are from consensus, the extra priceless it’s.

- Bicycle dimension share: Occasion agreements could let you purchase shares between 1 cent and 99 cents. Because of this a single contract can tackle as many contracts as you want, with out deterrent prices.

- New “hedged” dangers: By floor new data and offering contracts, the forecast market will end in members having the ability to Hedging in opposition to dangers in different markets. For instance, when you have been frightened {that a} geopolitical occasion might have an effect on oil costs, and when you depend on a few of your different investments, you can probably use an occasion settlement to hedge that danger.

Cons of the forecast market

- Similarities to playing: Many occasion contracts merely gamble below a special title, like binary choices. In truth, sporting occasions are a preferred theme within the forecast market. However even different monetary contracts are related, resembling whether or not the inventory or index reaches a sure stage by the top of the day. Such contracts are very related Zero Day Choices – Quick-term, all or ignorant payoffs and losses that don’t require experience. So there’s actually no funding right here. It is an nearly short-term guess on the occasion.

- Bets about “not understanding”: Many occasion contracts don’t require experience and are merely suggestion bets to the result of one thing roughly meaningless. Elon Musk’s weekly tweet rely is a superb instance. Contributors should not capable of know this type of data. That is only a guess.

- The market is inefficient and is being “recreation” by bots. Analysis means that the forecast market shouldn’t be as environment friendly and that the sport is being filmed by bots that make the most of inefficiency. A survey of IMDEA Markets on 86 million bets from April 2024 to April 2025 means that bots can leverage mispricing in numerous markets by arbitrage to make risk-free earnings. The likelihood of YES and NO outcomes ought to at all times be a complete of 100%, however typically (as within the real-life instance above) doesn’t, giving Lightning Quick Bots the chance to commerce and revenue from risk-free arbitration.

- It’s prohibited in lots of nations: As a result of its playing nature, the forecast market could also be banned in lots of locations. For instance, polymets are banned in a substantial variety of nations, together with France, Switzerland, Singapore and Thailand. It has been blocked within the US since 2022, however latest purchases of by-product exchanges might probably let you return to the US. That mentioned, calci within the forecast market is authorized in all US states.

- It’s possible you’ll use Stablecoins: Forecast markets resembling Kalshi and Polymarket use USDC Stablecoin. stablecoins It is similar to the US greenback, however with extra necessary and probably critical dangers that aren’t resolved by it Lately handed genius regulation.

Conclusion

To buyers, the forecast market seems to be extra like a playing than an funding, and whereas some occasion contracts could present priceless data, many are silly bets on trivial information. Subsequently, buyers seeking to “make investments” in forecast markets ought to fastidiously think about what advantages they’re gaining in comparison with investing in a enterprise that infuses them with truly thriving money.