Picture supply: Getty Photos

Scottish Mortgage Funding Belief (LSE:SMT) is FTSE100 It is fashionable amongst particular person buyers, together with the author right here. Motley Idiot. One purpose for that is that it gives publicity to rising corporations that aren’t listed on the general public markets.

Importantly, these should not start-ups in a dimly lit storage. Scottish Mortgage has important long-term holdings in a few of the world’s most progressive privately held corporations.

For instance, funds infrastructure supplier Stripe has had a tough go of it. $1.4 trillion Complete quantity paid final yr. That is roughly 1.3% of world GDP.

In the meantime, TikTok proprietor ByteDance outperformed Fb and Instagram’s mum or dad corporations. meta World income elevated earlier this yr.

One other holding firm, information analytics firm Databricks, is reportedly in talks to lift capital at a hefty $134 billion valuation. It’s at the moment registering greater than 50% progress as a result of elevated use of cutting-edge AI merchandise.

Final, however actually not least, is SpaceX, the reusable rocket pioneer whose worth has ballooned to turn out to be the mutual fund’s largest holding. And immediately (December 10), it was thrilling information from SpaceX that despatched Scottish Mortgage’s share value up 3%.

Here is what shareholders have to know.

A doubtlessly blockbuster IPO

Based on ReutersSpaceX plans to record on the inventory market in June or July subsequent yr. It’s anticipated to lift greater than $25 billion at a valuation of greater than $1 trillion.

nevertheless, bloomberg Based on the article, the quantity might attain $1.5 trillion. If that have been the case, we might be competing with oil corporations. saudi aramcohad a report preliminary public providing (IPO) in 2019.

That is nice information for Scottish Mortgage shareholders, because the belief first invested in SpaceX in 2018 at a a lot decrease valuation. And the corporate now has privileged entry to Elon Musk’s funding after patiently backing one other of his extra uncommon ventures: an electrical car startup. tesla).

In 2018, SpaceX was valued at about $31 billion. Due to this fact, if the IPO goes by means of efficiently, Scottish Mortgage’s web asset worth (NAV) might be considerably boosted.

Presumably, that will enable the belief to crystallize giant income and supply money for brand spanking new investments and inventory buybacks.

orbital information middle

After all, there’s a chance that this IPO won’t materialize. Just lately, Elon Musk denied reviews in regards to the funding, writing:SpaceX has been money circulation optimistic for years”.

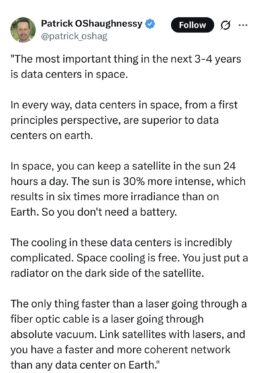

Nonetheless, space-based information facilities could require new capital. These are proposed as a way more power environment friendly resolution to information facilities on Earth.

Large know-how corporations like Google microsoft There may very well be extra demand for SpaceX’s reusable Falcon 9 rockets because it begins pumping information middle infrastructure into orbit.

And if profitable, the corporate’s big rocket, Starship, will take its aggressive benefit to a different degree (although it is nonetheless in its testing levels).

However, there’s Starlink, an web satellite tv for pc enterprise. This may drive many of the firm’s anticipated $22 billion to $24 billion in income subsequent yr.

Must you purchase SpaceX inventory?

Wish to spend money on SpaceX? Probably, the implied price-to-sales a number of of 50-65 appears very excessive. So I will in all probability wait.

Within the meantime, buyers could think about shopping for Scottish Mortgage shares. Whereas actually weak to tech sector selloffs, SpaceX’s publicity is strong, buying and selling at a sexy 12% low cost to NAV.

I feel affected person Scottish Mortgage shareholders might be rewarded with market-beating efficiency over the long run. However there are additionally ups and downs alongside the way in which.