Picture Supply: Getty Pictures

Palantir expertise (NASDAQ: PLTR) Stock is within the behavior of exploding greater after income reporting. This has risen by 780% heart-wrenching over two years!

The AI software program firm reported second quarter income on August 4th. Do I must snap some shares earlier than this occasion?

A booming AI enterprise

Palantir develops software program that enables organizations to investigate and act on giant quantities of information. Its giant buyer base contains the US Military, CIA, NHS England and extra. Airbusand Ferrari.

Lately, it’s the firm’s synthetic intelligence platform (AIP) that has supercharged its enterprise and inventory costs. AIP integrates organizational non-public knowledge and workflows straight with large-scale language fashions (LLMS) and different AI instruments.

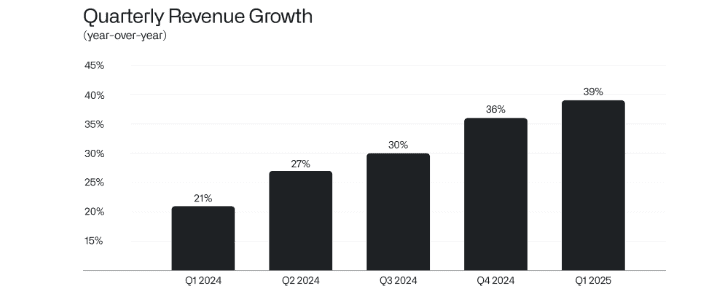

The surge in contracts signed by AIP is most distinguished throughout the pond. Within the first quarter, US revenues rose 55% year-on-year to $628 million, whereas US industrial revenues misplaced 71%. General revenues rose 39% to $884 million.

Impressively, Palantir closed 139 offers for a minimum of $1 million, 51 offers for a minimum of $5 million, and 31 offers for over $10 million in the course of the quarter. Adjusted free money circulate is $370 million, which is appropriate for a really wholesome 42% margin.

The primary cause for the unimaginable rise in shares is the accelerated quarterly income development. At any time when this occurs, buyers are naturally very excited (particularly when pushed by AI).

Co-founder and CEO Alex Carp commented:It is a spectacular surge and fierce development degree for a tenth of our dimension. However on this scale, we consider our rise is unparalleled. ”

Did you miss the boat?

Clearly, that is all very spectacular. Nonetheless, everytime you see Palantir, you can not really feel the ache of remorse. That is as a result of I used to be kicking the tires of this inventory, which was $9 a number of years in the past. However I by no means invested.

Now I can not assist however really feel like I missed the boat. As a result of Palantir has an enormous market capitalization of $373 billion. This makes it the twenty first largest firm in america. coca cola, McDonald’sand Financial institution of America.

Plus, it is traded for 126x gross sales, which appears ridiculous to me. Why is that so? It’s because Wall Avenue presently has a pencil-tightening of about 30-35% development over the following three years. In my view, it’s positively spectacular, however it doesn’t justify a 126x gross sales.

There are various dangers on this evaluation. If AI spending abruptly slows down or revenues are barely lighter, stock could possibly be bought considerably.

Additionally, a lot of the expansion Palantir is presently seeing is presently associated to the US, with CEOs being extraordinarily vital of Europe, which isn’t embracing AI. He reportedly stated thatSimply as folks gave up“When speaking concerning the ambitions of European AI.

Subsequently, a lot of Palantir’s development lies within the US (and different pockets like Saudi Arabia). Subsequently, the US recession brought on by tariffs is a short-term threat to development.

My motion

For my part right here, Palantir is a world-class software program firm with nice long-term alternatives in AI. Nonetheless, shares are very costly for me to really feel comfy investing as we speak.

Nonetheless, if there’s a large pullback within the inventory value, that turns into a unique matter.