Picture supply: Getty Pictures

Final yr, we thought of including Fundsmith Fairness to my Shares and Shares ISA. However I’ve come to the conclusion that we’d like extra proof that coach Terry Smith could be the very best in the marketplace after 4 consecutive years of underperformance.

Final week, Fundsmith introduced its 2025 annual outcomes. Given all this, is now the proper time to take a position?

efficiency

For these unfamiliar, Fundsmith invests in high-quality companies with sturdy manufacturers, aggressive moats, excessive returns on capital, predictable money movement, and the flexibility to develop income with out the necessity for vital debt.

Smith boils this all the way down to a easy three-step mantra.Purchase good corporations. Do not overpay. do nothing”

By doing this, Smith outperformed the fund’s benchmark (MSCI World Index) from 2010 to 2020. However since then, Mr Fundsmith has now underperformed for 5 consecutive years.

In 2025, the return was solely 0.8%, whereas the MSCI World Index rose 12.8%. That is very disappointing in a powerful yr when most indexes soared.

What went improper?

Smith stated three issues assist clarify this poor efficiency.

- Radical S&P500 exponential focus

- passive index investing

- weak greenback

The final one would not actually matter to me. However Smith factors out that on the finish of 2025, the highest 10 shares accounted for 39% of the S&P 500 and delivered 50% of complete returns.

The fund supervisor argues that it will have been very tough to outperform in recent times with out holding a big place in Magnificent Seven shares.

Sure, it is tough, however not not possible. For instance, Invoice Ackman (pershing sq.) and Chris Horn (TCI Fund Administration) outperformed the S&P 500 over the previous 5 years with out proudly owning any shares. tesla, meta, appleor Nvidia.

He additional argues that passive index funds distort the market by shopping for shares with out regard to high quality or valuation, basically making a momentum-driven bubble.

(E) Even when I’m appropriate in my analysis that this shift to index funds is among the causes of our latest poor efficiency and that it’s laying the foundations for a serious funding catastrophe, I do not know when or the way it will finish, apart from name-calling..

Terry Smith

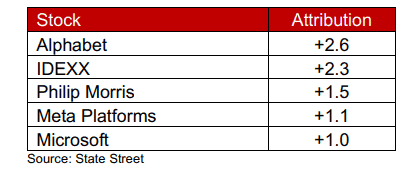

It is value noting that Fundsmith owns three Magnificent Seven shares (microsoftmeta, and alphabet), all had been among the many prime 5 contributors to 2025 efficiency.

In truth, that is the fifth time that Meta has appeared on Fundsmith’s prime contributor listing, and Microsoft has appeared on the listing for the tenth time. So whereas Huge Tech has helped drive the fund’s long-term efficiency (and it stays sturdy), Mr. Smith did not have sufficient publicity to the fund.

wegobee maker

novo nordisk (NYSE:NVO) crashed about 40% final yr, making it clearly Fundsmith’s worst performer. Wegovy producer fell behind rivals Eli Lilly The GLP-1 drug discovery race led to the ouster of the CEO.

However it’s value noting that the inventory has rebounded 17% to this point this yr following information that the corporate’s Wegovy remedy has been authorized by U.S. regulators in every day tablet kind.

Not solely will this enhance your competitiveness, nevertheless it may additionally get your gross sales development again heading in the right direction. The primary danger on this enterprise is that Eli Lilly wins it once more with an improved GLP-1 drug.

Nonetheless, I believe Novo Nordisk inventory is value contemplating, buying and selling at a ahead P/E of 16.7 occasions.

Nonetheless, I’ll give Fundsmith a miss. Steady efficiency degradation nonetheless worries me.