of helium one international (LSE:HE1) share worth is in nice form in the mean time. As of this writing (February twentieth), the inventory worth has elevated greater than 40% in comparison with a month in the past.

What’s behind the sudden curiosity on this little-known fuel probe? Let’s take a better look.

Picture supply: Getty Photos

1 finger for two pies

Helium One has two initiatives underway.

Probably the most superior is a three way partnership between Galactica and Pegasus in Colorado. And this seems to have been the catalyst for a lot of the group’s £19m market capitalization enhance over the previous 4 weeks or so.

The corporate lately said:Constant manufacturing unit administration” is scheduled for later this month because it prepares for manufacturing later this yr. Importantly, it additionally states:Discussions are underway relating to spot gross sales preparations for helium, in addition to long-term contracts with each helium and CO.2 The off-taker is shifting on.”

Nonetheless, this can be a comparatively small operation. The group expects that in March 2025,This may generate a mean of roughly US$2 million per yr for the corporate over 5 years.“This can be a income determine, not a revenue. For context, through the yr ended 30 June 2025, the group’s complete administrative bills have been $4.1 million.”

Nonetheless, this estimate doesn’t embody income from carbon dioxide (CO) gross sales.2). And there could also be additional undiscovered deposits of each gases.

However I feel shareholders imagine there are different doubtlessly larger prizes on the market.

a number of miles away

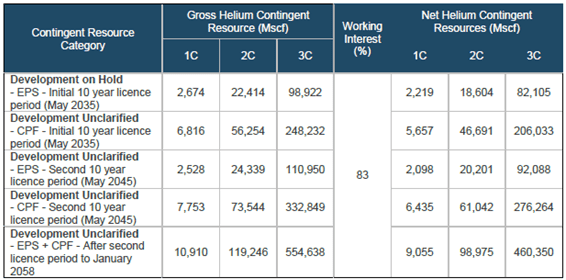

The group owns 83% of the Rukwa mission in southern Tanzania.

Right here, additional assessments utilizing an electrical submersible pump measured the water move charge. ”exceed expectationsThat is vital as a result of helium is just not a conventional drying fuel. As an alternative, it’s present in aquifers, which the group acknowledges.distinctiveAnd I feel this casts some doubt on its recoverability.

Nonetheless, if this problem could be overcome, there’s nice potential, in line with unbiased estimates of reserves. Nonetheless, given the industry-specific uncertainties, it is not uncommon to cite totally different numbers.

For context, there aren’t any spot costs for the fuel, however I’ve seen reviews that recommend helium can promote for as much as $1,000 per 1,000 normal cubic ft, relying on grade. Helium’s particular properties, particularly its cooling properties, are rising the demand for helium and doubtlessly rising its worth.

The final time I wrote about Helium One, I used to be contacted by an {industry} knowledgeable who claimed that it wasn’t.technically or economically doable“We wish to transport compressed helium from Africa by sea utilizing ISO tanks. After I approached the corporate’s representatives, they agreed. However they informed me:Helium may also be transported by ship as a compressed fuel in tube trailers”.

no thanks!

However I do not wish to make investments.

The corporate says it can want about $100 million to commercialize manufacturing. Due to this fact, I feel shareholder dilution will proceed additional. This isn’t a criticism. This can be a actuality for pre-revenue corporations. From June 2020 to June 2025, Helium One elevated its excellent shares by over 6 billion shares (3,417%).

There are various mining corporations which are already in manufacturing and, extra importantly, are well-financed. Primarily based on this, I feel there are much less dangerous alternatives to think about elsewhere.