Picture supply: Getty Photographs

of FTSE100 and FTSE250 They’ve elevated steadily to date in 2025, rising by 20% and seven% respectively. And we could possibly do much more within the coming months and years. However I believe there are extra British shares to purchase than simply London’s two most important inventory indexes.

Speculating on short-term inventory market actions is notoriously troublesome. However Citi analysts count on UK shares to soar over the subsequent yr. That is why I believe short-term and long-term traders must be cautious.

Aiming for gold

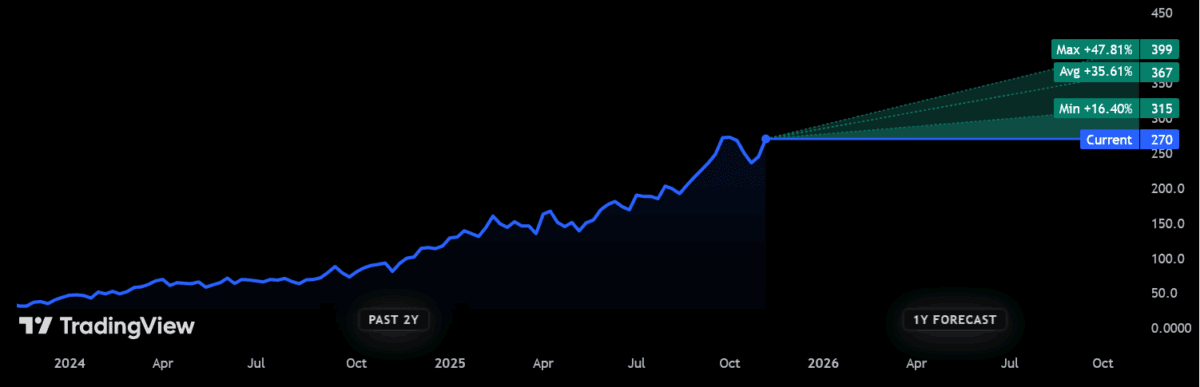

At 271.4 pence per share, pancake gold (LSE:SRB) has elevated in worth by 143% since January 1st. A surge in valuable metallic costs pushed costs even increased, hitting a brand new excessive in October at round $4,381 an oz.

Buoyed by a stable outlook for gold costs, dealer consensus suggests Seravi’s share worth will rise an additional 36% over the subsequent 12 months.

After all, additional will increase in gold costs will not be assured. Actually, if there’s any signal that the latest rally is shedding steam, gold mining shares like this one might fall sharply once more.

Nevertheless, given the continuing macroeconomic challenges and important geopolitical uncertainty, the general image appears constructive for safe-haven metals. morgan stanley Analysts count on gold to achieve $4,500 an oz by mid-2026.

Ceravi can be on monitor to extend manufacturing volumes to leverage this fertile atmosphere and ship long-term income development. Manufacturing within the first half of the yr was a file excessive of 12,090 ounces, a rise of 27% year-on-year. It’s anticipated to ship 100,000 ounces of fabric per yr by 2028.

The anticipated worth/earnings ratio (PER) of Ceravi inventory is 5.3 instances. This makes it one of many least expensive gold shares for my part, leaving room for additional worth appreciation.

greatest penny shares

At 52.5p, circulating monetary capital (LSE:DFCH) share worth is up a formidable 45% year-to-date. If predictions maintain true, penny shares might rise even increased over the subsequent 12 months.

The Metropolis predicts the specialist lender’s worth will rise by nearly two-thirds to 85p.

Word that just one analyst(s) presently have a ranking on the corporate’s inventory. This doesn’t present a variety of opinions. Nonetheless, I believe there’s good cause to count on DF Capital to take care of its spectacular momentum.

As with different monetary firms, income are extremely delicate to broader financial situations. So the grim outlook for the UK financial system is price contemplating by traders. Nevertheless, the corporate has been in a position to overcome these troubles and file shocking outcomes.

Due to new product launches and market share features, mortgage balances reached a whopping £759m on the finish of the third quarter. This was a rise of 26% in comparison with the earlier yr.

DF Capital’s inventory presently trades at a ahead P/E of 9.1. This appears very low cost for my part and I believe there’s room for additional worth will increase.