Picture Supply: Getty Photos

Self-investment Particular person Pensions (SIPPs) are the proper software for long-term traders. It is because you can not entry cash till you’re 55 years outdated (ages 57 from April 2028).

The benefit is that compounding curiosity can happen over time and SIPPS eliminates the temptation to promote shares to fund one thing (akin to cruise holidays/Christmas/New vehicles).

As Charlie Munger mentioned:The primary rule of compound curiosity is to not unnecessarily interrupt it. ”

All shares of FTSE 100by calculation Scotland mortgage funding trusts (LSE:SMT) is best suited for SIPP. Listed here are 5 causes.

1. Lengthy-term perspective

Scottish Mortgage manages a worldwide portfolio of private and non-private development firms on the funding horizon of 5 to 10 years. This explicitly asks shareholders to see their efficiency via this long-term lens.

So it chimes on the long-term level I simply made about SIPPS. These are perfect accounts that may overcome short-term noise (akin to tariffs, inflation, rates of interest) and obtain robust structural tendencies over time.

2. Progress theme

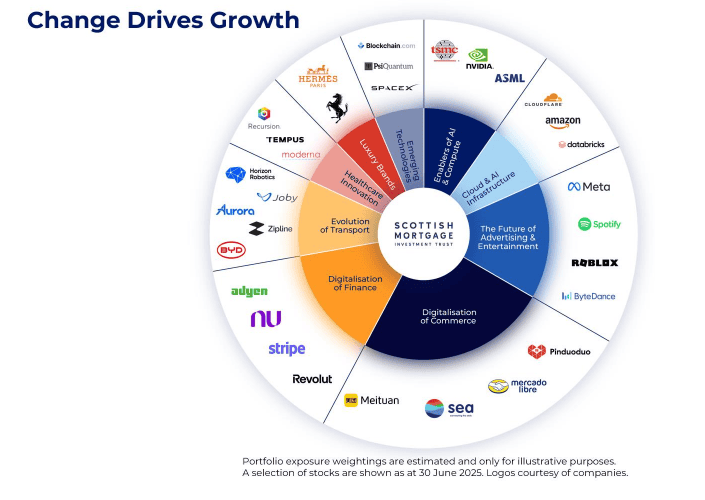

Talking of robust tendencies, Scotland’s mortgages are bullish with a handful. These embody monetary digitization, healthcare innovation, e-commerce and naturally synthetic intelligence (AI). Such themes are anticipated to drive development over the subsequent 20 years.

Beneath are key portfolio tendencies and corporations on the coronary heart of it.

There are some really world class firms right here, however many could be shocked if the long run did not turn into extra beneficial.

If you wish to put money into the most important winners, discover firms which might be profiting from a strong wave of change, together with new applied sciences, new markets, new behaviours and extra..

Scottish mortgage.

3. Non-public market

One more reason why I feel DIY pensions are price contemplating is due to non-public firms within the portfolio. There are thick positions in high-growth firms, together with Buitedan, which is owned by SpaceX, Databricks and Tiktok house owners.

FinTech invests in enormous stripes and revoluts for web funds. Corporations that change some of these video games are selecting to remain non-public for longer. In different phrases, retail traders are lacking out on development.

Scottish mortgages are uncovered to non-public and public firms. And whereas this provides a bit of additional threat (younger firms can break), the technique typically works nicely for shareholders.

4. Double-digit low cost

The odd factor about mutual funds is that they will commerce at premium or reductions with their underlying internet asset worth (NAV). This can be a threat as Scottish mortgage reductions can increase very considerably throughout instances of market stress.

Presently, the NAV low cost is 10.65%. There isn’t a assure that it will slim down, however it’s definitely higher to purchase shares at a double digit low cost than a big premium.

5. Out-performance

Lastly, Scottish mortgages have an unbelievable long-term report of outperformance. In keeping with Bellthe belief generated 15.7% annual income for the last decade.

In fact, this degree of efficiency could not final. However even when it will get just a little decrease, for instance at 12%, it nonetheless prices £300 a month to £506,402 over 25 years.

Moreover, any contribution to the SIPP has been topic to tax easing from the federal government. So, if High Up can also be invested in Scottish mortgages or equities providing comparable returns, the portfolio will probably be even greater.