Picture supply: Getty Photos

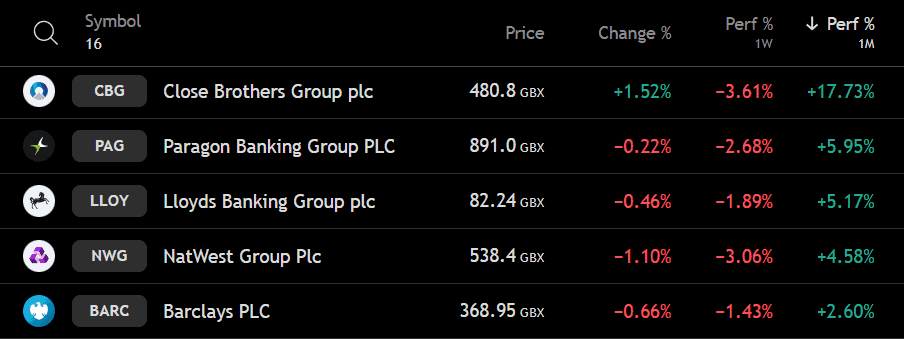

5.17% enhance Roy’s Shares went easily this month, beating all different main UK banks Nut waist, Barclays and HSBC. Because the UK’s largest retail financial institution, Lloyds is usually thought of the true nature of the sector.

However whereas it’s being guided FTSE 100 Pack, two areas FTSE 250 The gamers are literally forward.

Shut Brothers Group‘s (lse:cbg) jumped to 17.73% this month Paragon Banking Group‘s (lse:pag) is 5.95% (as of August twenty eighth).

It raises the query: do these little lenders supply the identical long-term worth as Lloyds? I made a decision to take a more in-depth look.

I am getting too near the solar

Shut Brothers is among the most notable performers of 2025, with its inventory virtually doubled for the reason that begin of the yr. Specialist Monetary Companies Group presents loans, securities buying and selling and funding administration options in quite a lot of areas.

Lots of the current rallies got here after the Supreme Courtroom overturned earlier rulings on automotive mortgage gross sales practices. The choice has heightened the clouds hanging from a number of banks that embody Lloyds, serving to to spark investor enthusiasm.

However this is the catch. Regardless of the inventory value being excessive, the shut siblings are nonetheless unprofitable. That newest consequence was swayed to a lack of £124 million, displaying a 172% decline. It raises questions on how sustainable the rally is actually.

To be honest, the inventory seems low-cost on paper and trades at a ratio of simply 0.47 with a constructive value (P/E) ratio of 8.2 and a value to ebook (P/B). Nonetheless, some analysts consider the excellent news is already priced. The RBC Capital Market not too long ago downgraded its shares to sector efficiency, conserving its value goal at 525p.

For my part, the chance is that if profitability does not final, shut siblings might wrestle to justify the current surge.

Dependable Revenue Shares

Paragon Banking Group, in the meantime, presents a extra secure story. Identified for specializing in skilled mortgages, shopper loans and buy-back lending, banks have constructed a status as reliable dividend payers. It at the moment generates 4.6%, supported by 20 years of fee historical past and a fee price of round 40%.

The analysis isn’t the aim, with the ahead P/E ratio being 8.6 and the P/B ratio being 1.2. Importantly, Paragon boasts a profitability – an working revenue margin of 21.5% and a 14.7% inventory return ratio (ROE). Within the third quarter transaction renewal, mortgage balances rose 4.8%, highlighting secure enterprise development.

The sentiments of the dealer are cautious, however constructive. On August twenty sixth, Jeffries issued a maintain score with a goal of 1,015p, however the broader analyst consensus is positioned at round 1,000p, which means a possible 12% enhance from right now’s value.

My Verdict

Regardless of surpassing Lloyds this month, Shut Brothers nonetheless reduce 58% of its worth over the previous 5 years. This yr’s restoration has paid off fantastically for shareholders, however with little overturning long-term papers, I do not contemplate shares.

Nonetheless, Paragon seems much more engaging. For revenue buyers in search of dependable, pretty worthwhile alternatives, it looks as if a inventory value contemplating. Lloyd’s might stay the UK financial institution heavyweight, however I feel Paragon deserves any watch checklist, in stability.