Picture Supply: Getty Pictures

Shares and fairness ISAs are robust funding automobiles. With entry to a lot of totally different investments and no tax on capital beneficial properties or revenue, you may generate plenty of wealth in the long run with both of those accounts.

Additionally, do not suppose you want to put money into £20,000 to thrive. So let’s check out how a lot a yearly funding of £2,000 is value by 2050.

Please observe that tax procedures rely upon every consumer’s particular person circumstances and should change sooner or later. The content material on this article is for informational functions solely. It’s not a type of tax recommendation or constitutes. Readers are liable for finishing up their very own due diligence and acquiring skilled recommendation earlier than making funding choices.

Engaging return

Utilizing shares and inventory ISAs, there is no such thing as a set or assured charge of return. In the end, your long-term returns will rely upon the belongings you invested.

Assuming a well-structured and numerous funding portfolio, I believe it could be affordable to anticipate a median return of 6-10% per 12 months in the long run. So, by 2050, let’s do some calculations to see what these return ranges can do to an funding of £2,000 a 12 months.

5 eventualities

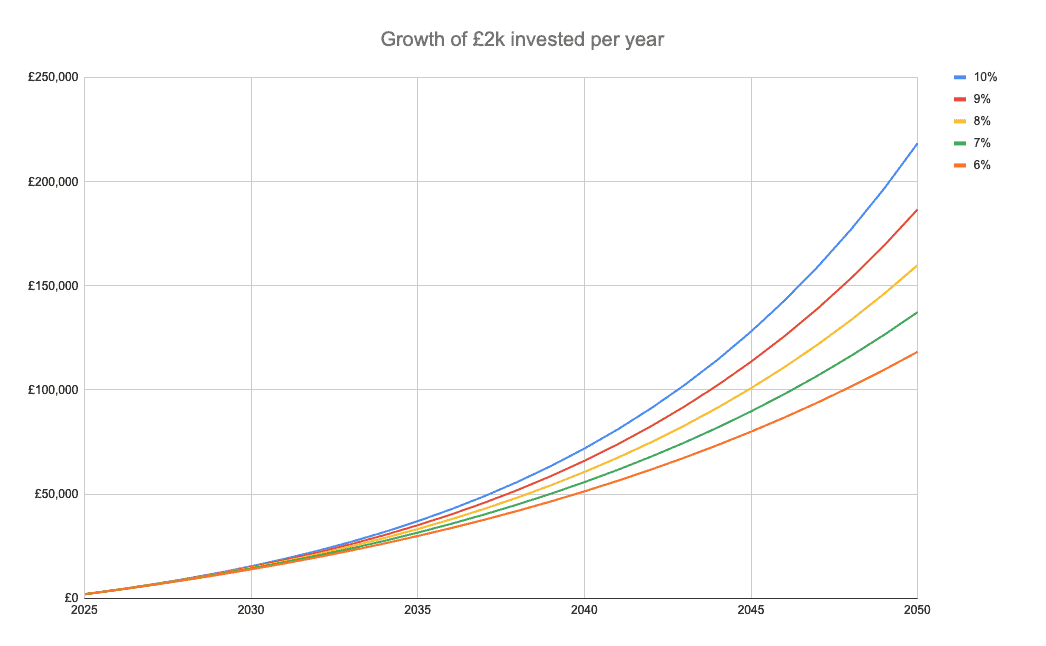

The chart beneath reveals progress of 2K kilos per 12 months. That is 5 percentages of 6%, 7%, 8%, 9%, and 10% return. It ignores the price.

With a 6% annual return, £2,000 per 12 months will enhance to round £118,000 by 2050. A ten% annual return could be round £218,000.

The ability of long-term funding

These calculations present the ability to put money into the long run (no tax). In the long term, even small quantities of cash can develop to giant quantities because of the energy of compound curiosity.

Additionally they present that a long time earlier than retirement might set themselves for the longer term by starting early. Over the course of 25 years, even in case you have a small funding, you may nonetheless construct a big quantity.

Generates a excessive return

Nicely, historical past reveals that producing a 6% annual return in the long run shouldn’t be that troublesome. Over the previous 10 calendar years, the UK FTSE 100 The index returned roughly 6.3% per 12 months.

Assuming that the index has produced the identical form of returns over the subsequent 25 years (possibly not), it’s attainable {that a} easy, low-cost footsheet lacquer fund might do the trick right here. Please observe that dividends should be reinvested.

It’s troublesome to attain 10% per 12 months in the long run, however not not possible.

To focus on this kind of return, we suggest contemplating a mixture of worldwide fairness funds and particular person progress shares. I exploit funds as the premise for my portfolio and use shares to develop extra shares.

The latter focuses on prime quality companies with nice long-term progress potential (buying and selling with affordable valuations). The instance right here is the proprietor of Google alphabet (NASDAQ: GOOG). The corporate has an unimaginable observe document in producing wealth for buyers. Over the previous decade, it has been returned 22% per 12 months As the corporate grows.

Wanting forward, I consider it may develop. Not solely will you profit from the expansion of YouTube and its cloud computing sector, you need to have the ability to see progress from Waymo and different promising enterprise segments.

After all, there is no such thing as a assure that this inventory will proceed to be supplied to buyers. If the substitute intelligence (AI) finally ends up destroying Google’s profitability, the return is unlucky.

Nonetheless, I believe stock is value contemplating. It at the moment trades at 22 future-proof worth (P/E) ratios that aren’t excessive for world-class high-tech firms.