Picture Supply: Getty Photos

For most individuals, 5 folks a month’s grand would do very effectively with passive earnings. Definitely, that could be sufficient to surrender on work.

Surely, one of the best ways to focus on dividend earnings is inside the inventory and shares an ISA. This account protects your tax returns and helps you construct wealth quicker.

Over the previous decade, ISAs have shared with shares that observe ISAs FTSE 100 The index simply surpassed money ISAs. The typical return is roughly 9% per yr. S&P 500 I used to be thrown into the combination.

In distinction, money has returned from about 2% to 2.5%, even together with excessive rates of interest since 2022. This means that inflation brought on the savers to lose their precise buying energy over this era.

Please notice that tax procedures rely on every shopper’s particular person circumstances and should change sooner or later. The content material on this article is for informational functions solely. It’s not a type of tax recommendation or constitutes. Readers are liable for finishing up their very own due diligence and acquiring skilled recommendation earlier than making funding selections.

We intention to have a £1 million portfolio

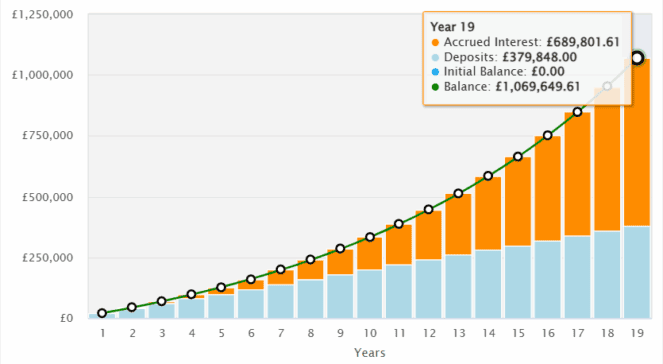

The annual contribution restrict for the ISA is £20,000. This implies it takes time to stack as much as the numbers listed within the heading.

For instance, for instance your portfolio generates 6% sooner or later. To earn £5,000 a month, ISA shares and shares should be value £1 million.

It is clearly some huge cash, and reaching it could sound like a dream, particularly if the annual ISA restrict is “£20,000”.

Nevertheless, they’re buyers who common 10% returns, and their seven-figure whole was achieved in just below 23 years. And the good information is that we invested £12,000 a yr (or £1,000 a month) reasonably than £20,000.

Nevertheless, if the complete ISA allowance is invested frequently, £1 million will likely be achieved inside 19 years! And each of those examples embrace folks ranging from scratch.

Now, I would like to say that there is no such thing as a assure of a ten% return, but when an organization encounters hassle, the dividend could be suspended.

Nevertheless, potential long-term rewards could be vital.

Pre-made progress portfolio

One strategy you should use to intention for a ten% return is to spend money on mutual funds. These are public corporations that typically buy a various asset portfolio of shares.

Baillie Gifford US Progress Belief (LSE: USA) is one thing I respect. It’s present in Belief High Holdings Meta Platformits income simply blows previous Wallsteet expectations. AI turbocharges advert efficiency throughout Fb and Instagram, providing effectivity and higher returns.

In the meantime, the sport platform Roblox I did one thing comparable. As I write in the present day (July thirty first), Meta and Roblox shares are up 12% and 17% respectively.

The belief supervisor seems to be an incredible inventory decide ( nvidia).

Nevertheless, one danger right here is that the portfolio is leaning closely in the direction of US tech shares. If these fall from bounty, belief is more likely to be a poor efficiency. There isn’t a geographical diversification both (though in the present day, high-tech corporations within the US are international lately).

The belief is presently buying and selling at a 7.5% low cost on its internet asset worth, which is interesting. I feel it is notably value contemplating as a solution to acquire publicity in your portfolio that can deepen the AI revolution.

As soon as the ISA reaches the magical £1 million mark, will probably be capable of focus totally on dividend shares. The historic portfolio of 6% will throw away tax-free passive earnings value £5,000 a month.