Picture supply: Getty Pictures

of glencore (LSE: GLEN) shares rose 8% in early buying and selling at the moment (9 January) following studies that: rio tinto (LSE: RIO) is in early-stage merger negotiations with RIO. FTSE100 Miner. This follows the proposed one anglo american–tech assets This exhibits that consolidation is again on the agenda within the metals sector.

However for Glencore, the main target is much less on the headlines and extra on what the deal means for copper and the way the corporate’s coal publicity suits into the dialogue.

Particulars of the merger

Preliminary particulars are restricted, with each corporations emphasizing that nothing has been agreed but. Rio Tinto is clearly trying to increase its copper portfolio, however Glencore has a serious buying and selling arm in addition to metals.

Coal is an apparent downside. Though Rio has utterly exited coal, Glencore’s operations in Australia and the remainder of the world nonetheless account for about half of its complete income. However coal is definitely much less central to Glencore’s money move than many assume.

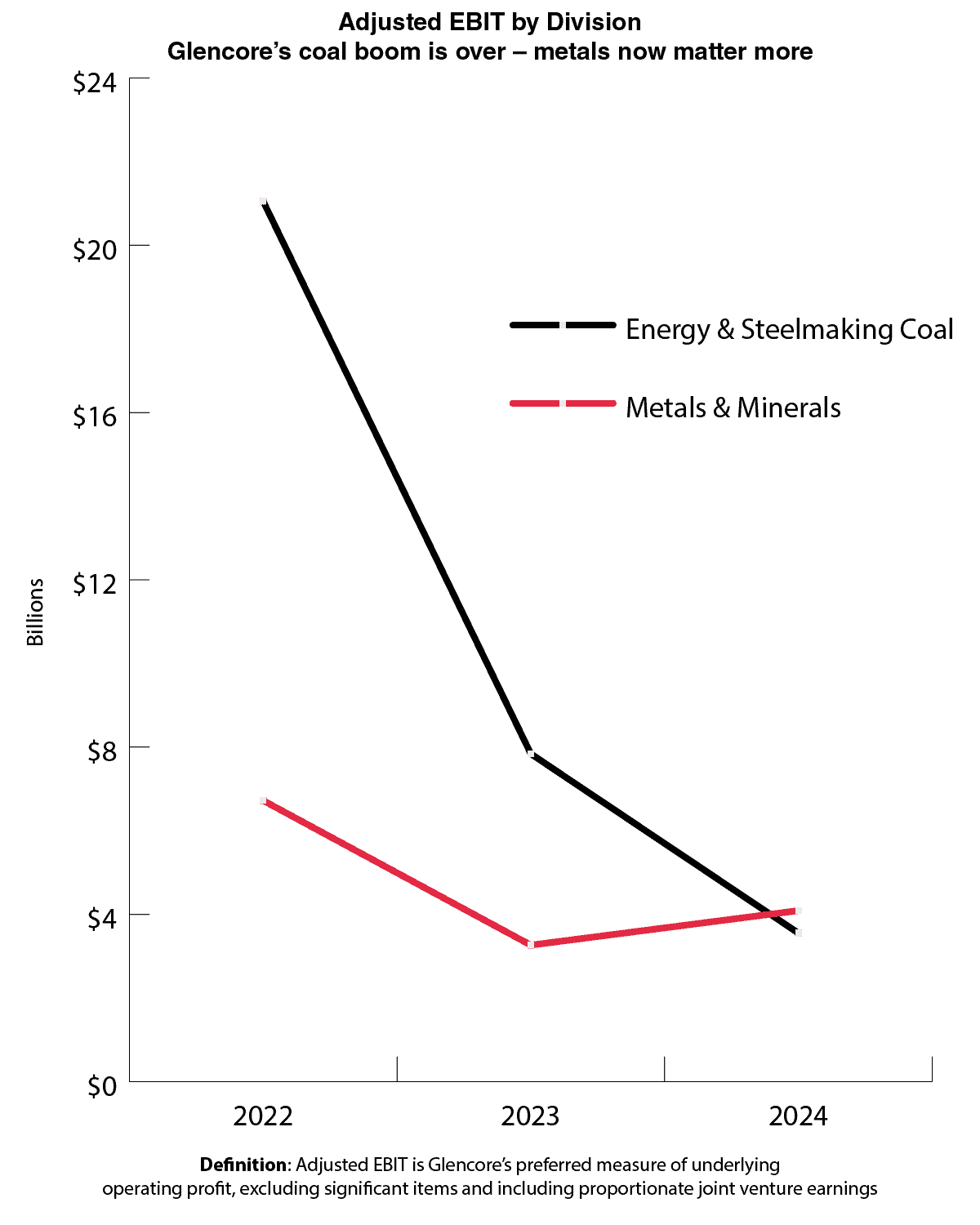

The chart under exhibits the corporate’s adjusted earnings (EBIT) throughout its two divisions. Whereas coal revenues have collapsed for the reason that post-COVID-19 surge, metals and minerals have remained remarkably resilient. The modifications will give Glencore extra flexibility in any deal and cut back the danger of a deal falling aside on coal alone.

Graph created by the creator

copper is the story

Should you strip away the headlines, that is principally a copper story. Glencore ranks as one of many world’s largest producers and goals to supply round 850,000 tonnes this yr, with the potential to achieve 1.6 million tonnes by 2035.

Provide is constrained. Chile’s output is flat, new discoveries are uncommon, and permits can take 15 years.

In the meantime, demand is rising because of electrification, renewable vitality, AI knowledge facilities, and industrial progress. Even a mixture of average worth stability and secure gross sales volumes can considerably enhance income.

In distinction, Rio Tinto invests much less in copper and depends extra on iron ore. Entry to Glencore’s copper property would give Glencore a way more dependable place in a market anticipated to be undersupplied by 30% by 2035. That is a very essential perspective for shareholders. Copper is now central to the vitality transition, and each corporations are taking a long-term view.

Glencore’s buying and selling enterprise is an ace within the trade. Many rivals tried to mimic it, however none succeeded. In a world of accelerating provide constraints and worth volatility, this sector is just about priceless.

threat

A merger of this dimension could be on the degree of a large company, and the authorized and regulatory hurdles throughout a number of jurisdictions could be extraordinarily excessive. Integrating two very totally different company cultures, one centered on buying and selling and one conventional mining, is not any small feat.

Though coal is smaller than it was once, it may well nonetheless elevate ESG, political, and financing points. And since the mixed firm is so massive, will probably be extremely uncovered to commodity cycles, geopolitical tensions, and operational disruption.

conclusion

The story of Glencore and Rio Tinto will not be about an instantaneous surge in share costs. It is about copper’s optionality, disciplined manufacturing, and strategic positioning in a market that can seemingly stay briefly provide for years to come back.

For traders used to Glencore’s volatility, at the moment’s merger headlines add context, however the fundamentals stay the identical. Copper stays the driving pressure and is the half most certainly to form earnings, progress, and long-term market relevance.