Picture Supply: Getty Photos

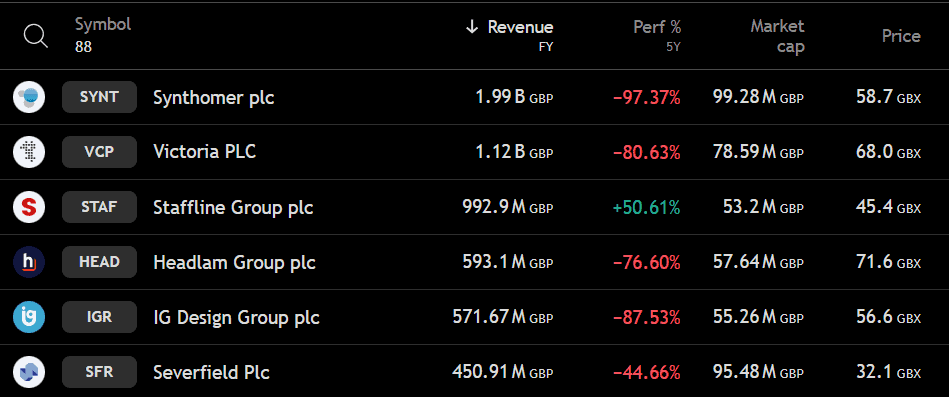

It isn’t unusual to see shares of pennies who suffered big losses, however few individuals have fallen in any respect. sythhomer (LSE: synt). The key provider of aqueous polymers, which has dropped by 97.37% over the previous 5 years, has develop into one of many worst penny strains within the UK.

Nonetheless, the corporate nonetheless generated income of round £2 billion final 12 months. That is greater than every other penny inventory in the marketplace. The previous elements FTSE 250Synthmers fell into the Pennystock territory final month after their market capitalization fell beneath £100 million.

In full-year outcomes for 2024, the group reported a web revenue lack of £72.6 million, a major lower from £208 million in 2021. The newest six-month leads to 2025 resulted in a lack of -26P in earnings per share (EPS) in comparison with the forecast for 2P earnings.

So what was fallacious – can it’s recovered?

The 12 months of increase and bust

The synthmer story is likely one of the cycles. In 2018, the corporate quickly elevated the demand for nitrile butadiene rubber (NBR), a key ingredient in disposable medical gloves. Revenues skyrocketed, and the acquisition helped the group place themselves as a worldwide specialist chemistry participant, giving traders confidence of their progress story.

By 2019, that momentum had disappeared. Elevated uncooked materials prices and decrease demand in Europe and Asia noticed revenue contracts. Then got here the 2020 and the pandemic. As soon as once more, demand for gloves spiked, sparking one other rally.

Nonetheless, the increase was short-lived. With the acquisition of Omnova Options in 2020, the corporate was in debt. Because the pandemic waned and glove demand normalized, synthmers left their steadiness sheets below rising prices, decrease income and stress.

The shares presently buying and selling at round 58p have fallen 98.5% since September 2021 exceeded 4,000p. Buyers who purchased on the high have seen the extraordinary worth worn out.

Growth and finance

In October 2021, Synthmer bought Eastman Chemical’s adhesive enterprise for $1 billion. This was achieved by a Dutch manufacturing facility that produced roughly 80 kinds of artificial resin. The transaction expanded its product base however was added to the debt pile.

Nonetheless, the steadiness sheet shouldn’t be with out its advantages. The group holds £996.6 million in fairness on property and £2.45 billion in liabilities and £960 million. It additionally generated £15.7 million in working money move final 12 months.

Administration is presently specializing in derevalization, with contract aid agreeing to lenders operating till 2026, giving some respiratory chambers. Moreover, free money move improved final 12 months, with web debt already almost half of its earlier stage.

Can I get better?

The restoration will rely on lowering the online debt to prawn dab ratio to a safer stage. That features promoting non-core property, refinancing on higher phrases, or ready for rates of interest to be eased. Indicators of stabilizing income or lowering debt can encourage synthmer inventory valuations.

Personally, I believe this penny inventory is value contemplating just for traders with a high-risk desire. It could possibly be a traditional high-risk, high-reward turnaround story.

However to me, heavy leverage, steady losses and unsure macroeconomic setting appear too speculative for now.