Picture supply: Getty Photos

Duolingo (NASDAQ:DUOL) is a progress inventory that has loved a stomach-churning rise since its 2021 IPO.

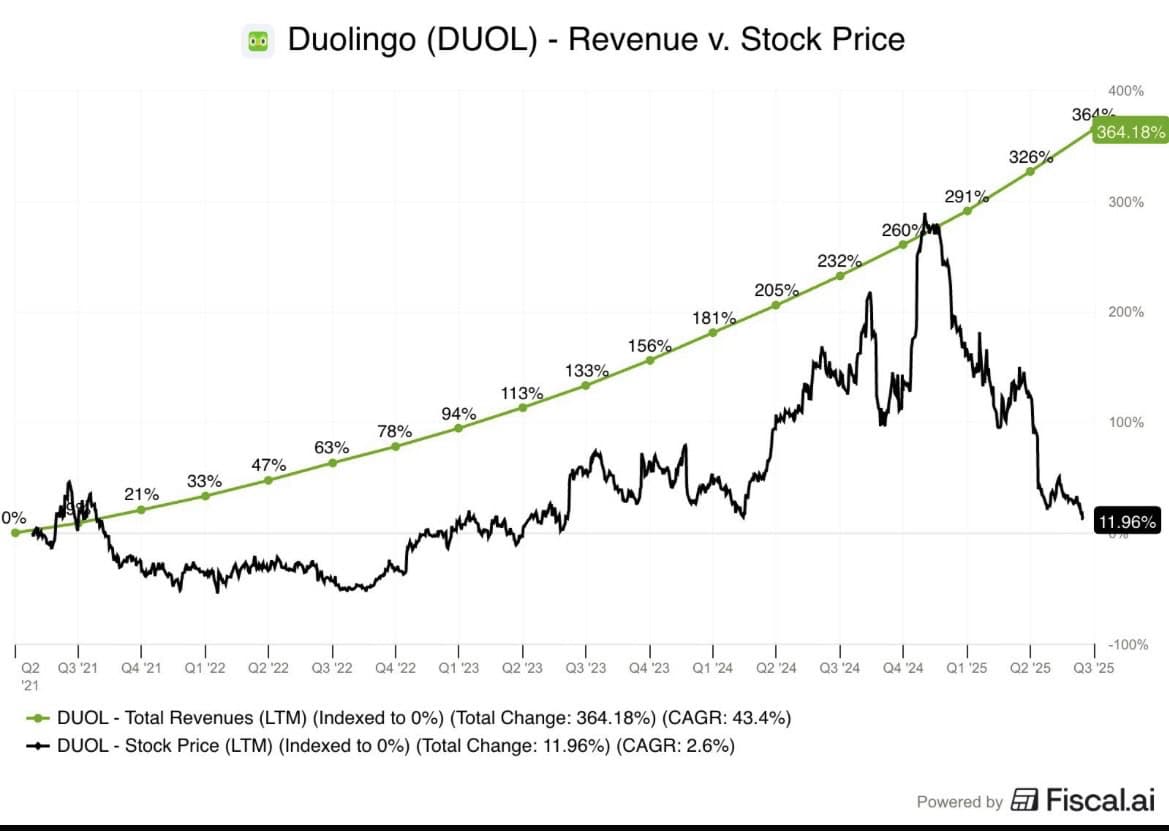

After beginning at $141, it misplaced 50% of its worth by early 2023 and soared 630% to a peak of $544 by Might 2025. Since then, it has plunged 73% and is now again to its start line of $142.

I purchased the language studying firm’s inventory 3 times in 2025. And my inventory holdings are at the moment underwater with a 50% loss.

What a catastrophe!

Is Duolingo going to be discontinued in my Shares and Shares ISA?

guidelines

The primary time I attempted Duolingo, I wasn’t satisfied. I used to be anxious that this was simply one other busy, gamified language studying app that could possibly be simply replicated.

Simply because an app is in style does not imply it is a good funding (pun meant). snap or pinterest). I used to be anxious that Duolingo did not have a sturdy moat.

However one after the other, I began checking off the containers on my progress inventory guidelines. I’ve listed a few of them beneath.

| Massive market? | There are roughly 2 billion language learners. Duolingo has 52 million every day lively customers (about 3% of the entire). |

| The best way to clear up the issue? | Language requires every day observe. Duolingo gamifies the training expertise to maintain customers motivated. |

| Unique moat? | Its AI fashions are skilled on billions of every day studying occasions. No competitor has greater than 10 years of detailed information. |

| Wholesome unit economics? | The corporate boasts excessive profitability and free money circulate. |

| Is it modern? | Duolingo makes use of AI-powered avatars to observe your talking expertise in real-time. |

| Visionary management? | CEO Luis von Ahn invented reCAPTCHA. He intends to show AI-driven apps to billions of individuals. |

| Arbitrary? | sure. Duolingo at the moment provides programs in math, music, and chess, in addition to greater than 40 languages. |

Along with this, I search for one thing uncommon or distinctive about my rising firm (one specific firm). I do not perceive somethingI, so to talk). The corporate suits the invoice with its quirky Duo owl mascot and quirky social media marketing campaign.

Von Ahn describes the corporate’s tradition:wholesome however free”.

What went unsuitable?

The corporate’s newest outcomes for Q3 2025 had been strong. Income elevated 41% to $271.7 million, and adjusted EBITDA margin expanded to 29.5% from 24.7% a 12 months in the past. Paid subscribers grew 34% to 11.5 million, with Asia now the corporate’s quickest rising area.

However there are two issues which are stunning the market. One is that the corporate will give attention to:Making the free model the most effective factor ever…nice free merchandise drive phrase of mouth and finally subscriptions”.

Wall Avenue would not prefer it when firms sacrifice short-term earnings to advertise long-term progress. After the third quarter outcomes, the inventory worth plummeted 25%.

In 2005, Amazon CEO Jeff Bezos stated,All-you-can-eat categorical supply“Service (aka Amazon Prime). Wall Avenue hated it.”charity venture” Nevertheless it finally made Amazon extra aggressive.

I believe Duolingo’s strikes to enhance the standard of schooling in its app will finally result in elevated subscriptions and drive income progress. Nevertheless, a slowdown in bookings clearly will increase near-term uncertainty.

The second concern is the overall concern that AI will disrupt complete software program/know-how classes. In Duolingo’s case, some traders are involved that learners will swap to ChatGPT and different free AI apps.

Whereas it is a theoretical danger, it hasn’t occurred but, and AI-generated code hasn’t knocked out an app in a competing language in every week. Moreover, it’s good to encourage behavior formation to maintain learners from quitting, which Duolingo has mastered.

Personally, I believe the specter of AI is significantly overstated. However solely time will inform.

Duolingo of future?

Duolingo has returned to its IPO worth regardless that its income has elevated by about 4x and the variety of paid members has elevated by about 5x since 2021. Even CNBC’s Jim Cramer, who would not charge Duolingo’s prospects, now says the inventory is “oversold”.

In different phrases, there’s at the moment a transparent mismatch between inventory costs and underlying fundamentals. So, whereas I’ve no intention of promoting the shares, I nonetheless suppose they’re value contemplating as a part of a diversified ISA.