Picture supply: Getty Pictures

Dividend traders ought to concentrate on financial institution shares. The outlook for a fall in rate of interest is an actual danger, however not every thing FTSE 100 The banks are the identical.

Barclays (LSE: BARC) is exclusive to mix a robust retail presence with international funding banking. Stock can also be attention-grabbing from a dividend perspective.

dividend

At present, Barclays shares have a dividend yield of two.2%. in comparison with Lloyd’s Banking Group (3.95%) or Natwest Group (4.42%), which isn’t significantly eye-catching.

However relating to dividends, there’s way more to Barclays than to make eye contact. In February 2024, the corporate introduced a particular strategy to shareholder returns.

As an alternative of accelerating dividends, the financial institution selected to concentrate on inventory buybacks. In consequence, dividends per share elevated, however solely due to a lower within the variety of shares.

This implies a extra modest dividend yield, but when issues go nicely, development needs to be strengthened sooner or later. And that is actually what analysts anticipate.

Outlook

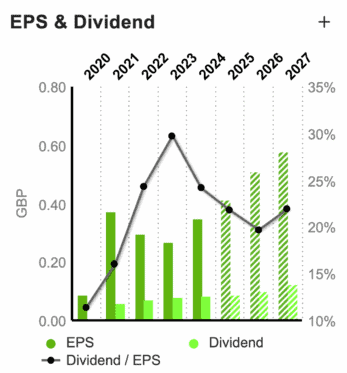

In 2025, Barclays is anticipated to return 0.902p per share in dividends. That is 7% larger than the earlier 12 months, however the forecast is that issues will occur considerably after 2026.

The most recent figures I can discover elevated to 10.06p per share in 2026 and surged to 12.65p in 2027. This implies a 3.28% return primarily based on the present inventory worth.

By way of annual development, that is an 11.5% improve adopted by a 27.5% improve. These are the rises that even a number of the UK’s high development shares have seen greater than admirable.

Nonetheless, dividend traders could query how reasonable that is. If the entire distribution stays the identical, their development assumptions forged a number of expectations on the inventory buyback program.

Share the buyback

Final February, Barclays introduced plans to return £10 billion to shareholders by the tip of 2026. And it is halfway by way of that program, with £3.755 billion getting used for inventory buybacks.

In doing so, the financial institution has decreased its Shet accounts by greater than 11%. This is the reason Barclays returned the identical amount of money total, nevertheless it nonetheless elevated dividend per share.

The corporate presently has a market worth of round £55 billion, so it can take a number of time to chop the variety of excellent shares by an extra 10%. And that is price noting.

Barclays’ inventory worth has greater than doubled because the firm first outlined its technique. And this may considerably scale back the impression of utilizing money to purchase again shares.

Dividend development

If the inventory commerce is beneath the ebook worth, inventory buybacks can improve the worth of Barclays shares. However I feel traders have to be reasonable in regards to the future.

Buyback alone will trigger dividend development of 11.5% and take a number of time to generate 27.5%. There may be additionally the chance that inflation might probably scale back rates of interest extra slowly than anticipated.

In such circumstances, funding banking actions could not take off in the best way some analysts anticipate. It will make the financial institution’s distinctive construction a weak spot relatively than energy.

Totally different traders have completely different priorities. However from a passive earnings perspective, I feel there’s a more sensible choice than Barclays.