Picture supply: Getty Photographs

glencore (LSE: GLEN)’s share worth has soared since bottoming out in April final 12 months following the so-called Liberation Day sell-off. The enterprise is now again within the black and has introduced daring plans to grow to be the world’s largest copper producer. So may the inventory be on the verge of a serious revaluation available in the market?

Achievements in 2025

The mining large’s full-year outcomes recommend a shift within the cycle slightly than a weakening of its enterprise. Adjusted EBITDA fell 6% to $13.5 billion, beneath the height of $34 billion throughout the 2022 vitality shock, however statutory revenue for the 12 months returned to only $400 million, returning it to official surplus.

Within the second half, the momentum received significantly better. EBITDA elevated 49% in comparison with the primary half, pushed by larger metallic costs, a rebound in gold and a virtually 50% surge in copper manufacturing.

Coal stays a drag, with costs for thermal energy era and metal manufacturing anticipated to fall by greater than 20% in 2025, placing strain on profitability.

Shareholders are nonetheless being paid a ready charge. The fundamental distribution of 10 cents will stay unchanged, however will obtain an extra 7 cents as a result of funding from not too long ago listed corporations. Bunge Shares – Dividends improve to $2 billion in 2026, translating to a dividend yield of three.4%.

vitality transition

What continues to face out is Glencore’s place on the intersection of conventional fuels and transition metals. Coal costs could also be falling now. However in mining, the answer to low costs is low costs.

Mining is cyclical and provide is already reacting. In Australia, producers are chopping manufacturing as margins erode. Alternatively, demand is just not disappearing, it’s altering. Developed markets could also be phasing out coal use, however rising economies nonetheless want ample, low-cost electrical energy to develop.

Given sturdy demand in growing nations and tight provide, is it doable that as we speak’s drop in coal costs is definitely inflicting tomorrow’s rebound?

copper

Though greater than $10 trillion has been poured into renewable vitality over the previous 20 years, fossil fuels nonetheless present about three-quarters of the world’s vitality.

What occurs subsequent is even greater. Some $300 trillion might be spent over the following 20 years on transportation and energy electrification, grid upgrades, and AI enlargement, all of which would require staggering quantities of copper.

There isn’t a scarcity of copper within the floor. The bottleneck is extracting it. Tolerated delays, labor shortages and business warning imply new provide will battle to maintain up with future demand.

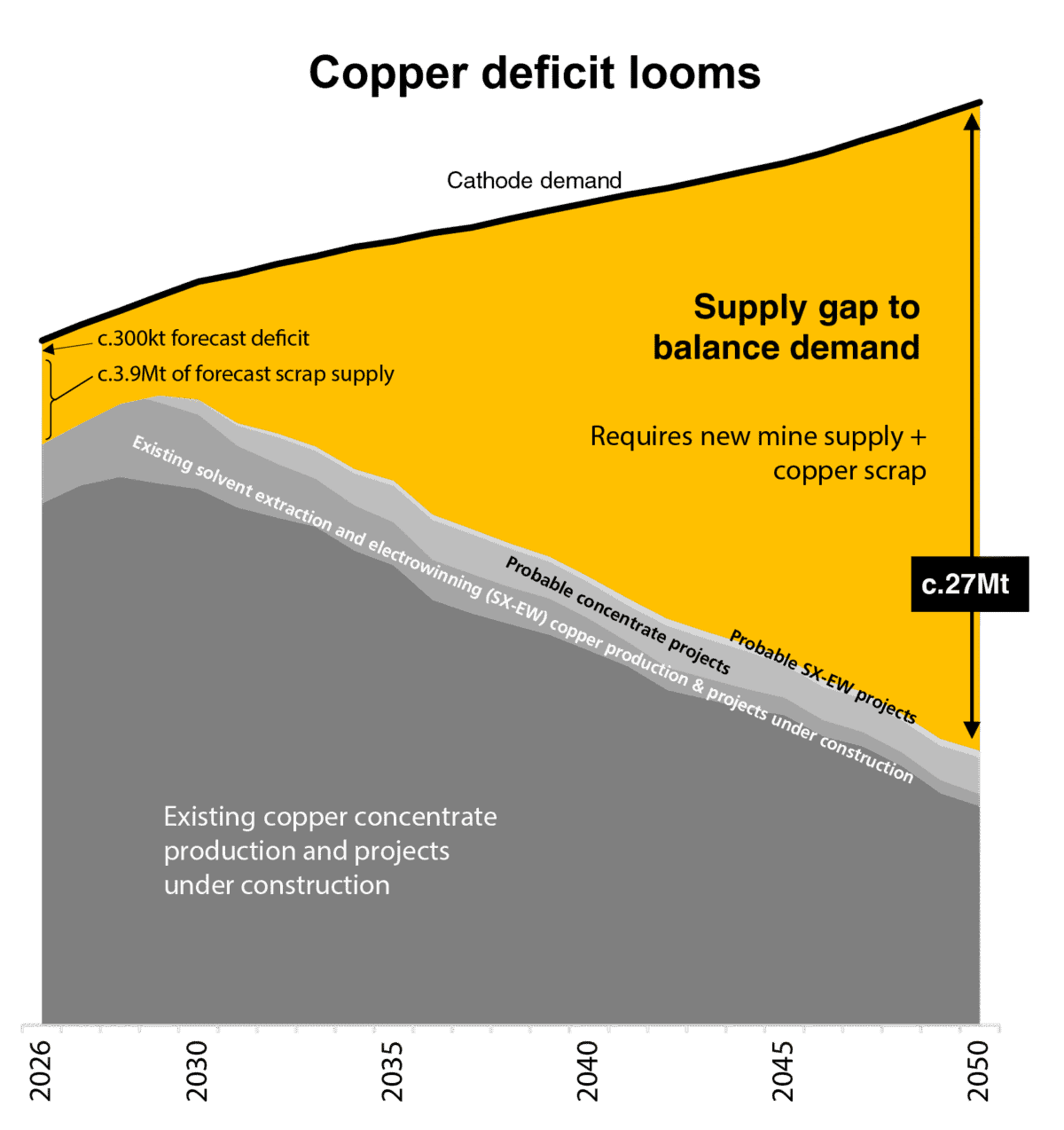

The graph beneath reveals how tight the market is. Based on inner estimates, the worldwide copper scarcity may attain 27 million tonnes by 2050.

Supply: Glencore

threat

Execution threat, slightly than commodity costs, might be an even bigger take a look at for Glencore. The corporate not too long ago pulled out of a proposed mega-merger. rio tinto The failure to agree on phrases reveals how tough it’s to find out long-term worth in a extremely cyclical business.

On the identical time, future development relies on bringing main copper initiatives on-line. To handle that threat, the corporate is in search of three way partnership companions for long-term greenfield improvement. This stability is delicate. Increasing too shortly reduces earnings. If we transfer too slowly, the structural provide scarcity may cross.

What’s the verdict?

I’ve lengthy believed that one of the best alternatives happen when pessimism is at its peak.

The previous few years have examined shareholder endurance, throughout which Glencore itself has been aggressively shopping for again undervalued shares. Earnings are actually recovering, metals momentum is constructing, and technique is aligned with the following commodity cycle. If sentiment modifications even barely, the potential for rerating could be vital. Is it value contemplating? I feel so.