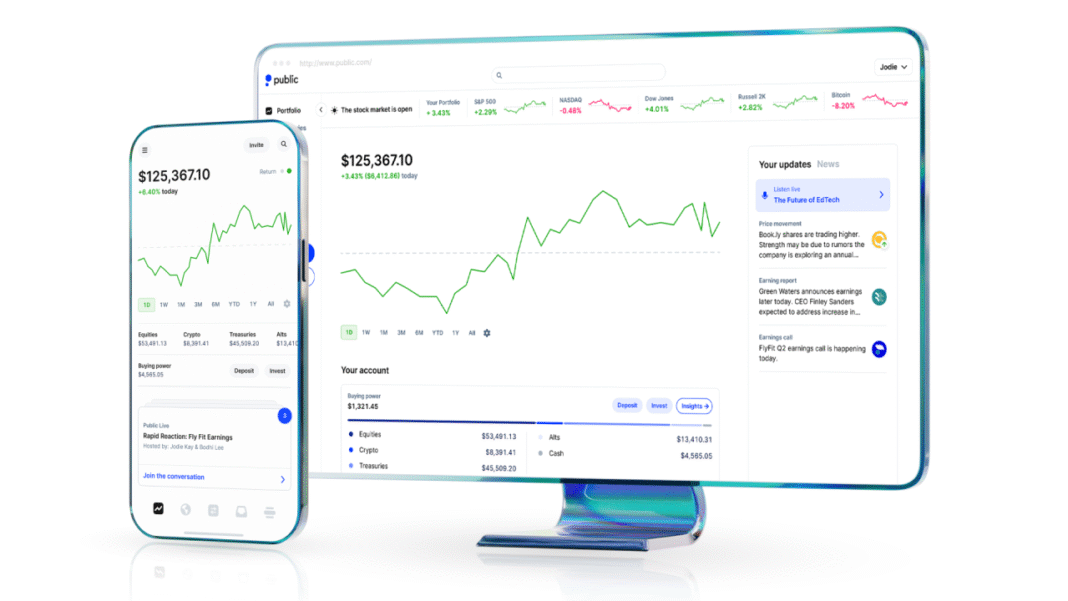

Public is an funding platform that gives a steady buying and selling expertise, free buying and selling of shares and ETFs, and quick access to bonds. Choices merchants may get again the funds they earn on their trades by way of Public’s rebate program.

Different major options embrace:

- Since they’re fractional shares, you possibly can commerce them for as little as $1 utilizing Public’s funding plan characteristic.

Though it’s a cryptocurrency transaction, transaction charges are charged by the cryptocurrency associate.

- Direct index. You may mimic an index, nevertheless it’s extra versatile than shopping for an ETF.

Whereas Public presents most of what the typical investor could be excited by, you will not discover mutual funds on the app. Moreover, traders who need the power to name customer support representatives along with electronic mail or chat could wish to think about conventional brokers similar to Constancy Investments or Charles Schwab.

Publication overview

| class | public |

|---|---|

| Minimal quantity for account opening | $20 |

| tradable securities | shares, ETFs, choices, digital forex, bonds |

| value per transaction | $0 (non-premium members pay) $2.99 for OTC buying and selling and after-hours buying and selling) |

| customer support | electronic mail and chat |

| Account sort | securities account, margin account, Roth and conventional IRAs |

| account price | Incoming and forwarding is free Outgoing ACH: $0 Outgoing ACAT: $100 Outgoing line (home): $25 There’s a month-to-month inactivity price of $3.99 per account Lower than $70 has been inactive for a minimum of 6 months |

| Bond account upkeep price | $0 ($3.99 per 30 days for non-premium members) |

| premium subscription | $10 per 30 days or $96 per 12 months (free with balances of $50,000 or extra) |

| cell app | Public cell apps are Apple App Retailer and Google Play Retailer |

| Please see Public pricing for extra info. |

Good for:

- choices dealer

- Funding in fractional shares

- bond investor

Benefits: Public visibility

Simple portfolio constructing software

At Public, our funding planning choices make it simple to spend money on pre-built portfolios tailor-made to your targets. Simply spend money on shares organized round themes, similar to AI corporations and inexperienced energy. It’s also possible to select a portfolio that fits your threat tolerance or one which focuses on bonds or high-dividend shares.

Wish to put your buying and selling on autopilot? Public permits you to arrange an funding plan to repeatedly purchase shares and ETFs with out remembering to switch cash to your portfolio. Premium members have entry to this characteristic at no extra cost, whereas non-premium members pay $0.49, $0.99, or $1.99 per subscription, relying on the variety of shares and ETFs of their funding plan (1-3, 4-10, or 11-20, respectively).

Direct indexing

Public additionally presents direct indexing, which lets you make investments immediately within the corporations that make up the index. You may want to take a position $1,000 to get began, however as soon as you have invested, you may have extra flexibility to construction your portfolio the best way you need and make the most of tax loss restoration.

Possibility pricing

Not solely does Public provide entry to $0 choices, nevertheless it additionally presents revenue sharing on choices buying and selling. Which means that shoppers can obtain 50% of the dealer’s income on trades, however they need to join this system. The web impact means that you could be (extremely) find yourself getting paid to your possibility trades.

For instance, Public estimates that prospects will obtain roughly $0.18 per contract traded, web of $0.15 per contract, after bearing in mind the regulatory charges assessed by all brokers. This pricing construction could make Public one of the best choices dealer amongst those who provide free choices buying and selling.

bond buying and selling

The general public providing started providing Treasury payments and company bonds in 2023, making its presence felt within the bond world. Buying and selling particular person bonds is usually an space reserved for extra refined traders, partially as a result of buying a single bond prices about $1,000, making it a prohibitive transaction for a lot of retail traders. The Nationals try to vary that and open up the market to extra individuals by permitting traders to purchase extra manageable parts of bonds within the $100 vary.

Public bonds have a price of $0.10 to $0.25 per $100 face worth, whereas company bonds have a price of $0.35 to $0.50 per $100 face worth. For premium members, there is no such thing as a month-to-month upkeep price for mounted earnings accounts, whereas non-premium members pay $3.99 per 30 days.

For traders seeking to additional diversify their bond holdings, Public presents a set earnings account that requires a minimal preliminary deposit of $1,000. This lets you spend money on a portfolio of 10 company bonds with a set yield set on the time of buy. Please word that the bonds supplied are of average credit score high quality. This implies there’s a larger stage of default threat related to the bond in comparison with larger rated choices. It is best to consider whether or not these bonds fit your threat tolerance.

Shares lower than one unit

Public permits fractional shares on its platform, so you too can purchase among the highest priced shares and ETFs. And with our funding plan characteristic, you possibly can personal something, regardless of how small, with minimal transaction quantities as little as $1. This characteristic makes your whole cash be just right for you, whatever the inventory value.

Public not solely helps shopping for a portion of the inventory, but additionally means that you can reinvest within the inventory. So if you obtain a dividend, you possibly can set the app to reinvest it within the inventory that paid it.

There should not many brokers that provide each options. In reality, Constancy, Charles Schwab, and Robinhood are the one main on-line brokers that provide each.

public premium subscription

Public Premium is a $96/12 months subscription service, or $10/month if billed month-to-month, that offers you extra monetary metrics to research your investments. It’s also possible to keep away from among the charges that non-premium members face, similar to the power to arrange automated funding plans at no extra value.

There’s a technique to skip the price. Simply have a $50,000 account and Public offers you entry to Premium at no cost.

Entry to cryptocurrencies

Along with shares and ETFs, digital currencies are additionally publicly obtainable. The app presents over 40 of the preferred cash, together with Bitcoin and Ethereum. Plus, you possibly can make investments from as little as $1. Zerohash, a associate of Public, expenses 1.25% of the transaction quantity above $500, and something beneath that on a sliding scale (e.g. $0.49 for trades as much as $10, $0.69 for trades between $10 and $25).

Cons: Factors that could possibly be improved for most people

Scarcity of funding trusts

If you wish to spend money on shares or ETFs, you may discover what you are on the lookout for right here. Contemplating the excessive threat, excessive return potential of choices, this selection is adequate for a lot of traders, maybe most traders.

However traders on the lookout for mutual funds might want to open an account elsewhere.

customer support

For some traders, electronic mail and chat entry could also be sufficient. I additionally emailed customer support throughout regular enterprise hours and obtained a useful reply inside an hour. Nevertheless, there could also be instances if you completely want to talk to a customer support consultant. As of this writing, Public doesn’t provide cellphone assist.

—Logan Jacoby contributed to this text.