Picture supply: Getty Pictures

of Fundsmith Fairness This fund has been a core holding in my shares ISA and pension accounts for a very long time. And in the long term it was a very good funding for me.

However lately I made a decision to dump the fund and reallocate its capital to different investments. The explanation why I took this motion are as follows.

Horrible efficiency in 2025

I’ve been involved in regards to the efficiency of this fund for a while. It’s because they haven’t stored up with the latest market.

Final 12 months’s efficiency was the final straw for me. A 12 months during which nearly all main indexes rose considerably ( MSCI World Index 12.8%), this fund returned simply 0.8%.

| 2025 | 2024 | 2023 | 2022 | |

| Fundsmith Fairness | 0.8% | 8.9% | 12.4% | -13.8% |

| MSCI World | 12.8% | 20.8% | 16.8% | -7.8% |

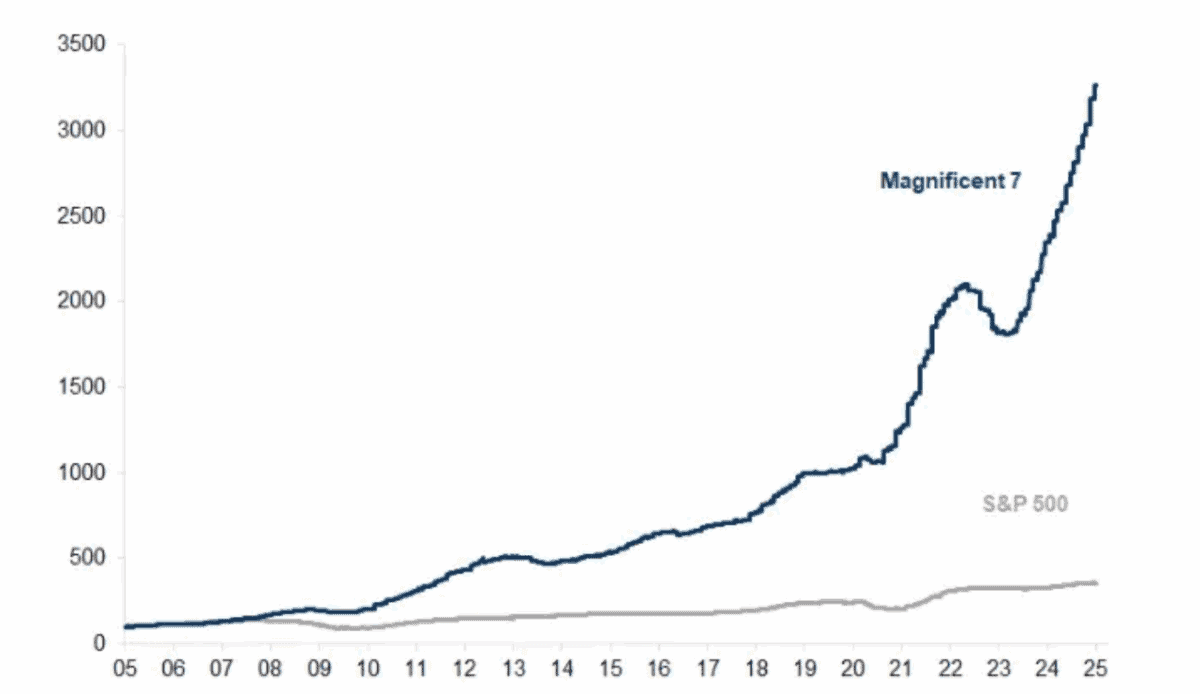

What went fallacious? Effectively, a part of the issue is that this fund hasn’t absolutely participated within the tech inventory growth.

In his annual letter, fund supervisor Terry Smith highlighted the present market focus on Magnificent Seven shares as a danger. Nevertheless, there’s a purpose why the market is concentrated in these corporations. It’s because company income have skyrocketed in recent times.

Outlook for 2026

Now, I like Mr. Smith’s “high quality” investing fashion. It is much like my very own fashion. However trying ahead, I doubt this fund has any likelihood of beating the market in 2026.

Right here we evaluate the fund’s high 10 holdings at the start of the 12 months and this 12 months’s high 10 holdings. Vanguard FTSE All World UCITS ETF (LSE:VWRP).

| Fundsmith Fairness | Vanguard FTSE All World UCITS ETF |

| waters | Nvidia |

| striker | apple |

| idex | microsoft |

| visa | Amazon |

| marriott | Alphabet class A |

| loreal | broadcom |

| LVMH | Alphabet class C |

| unilever | meta |

| alphabet | tesla |

| automated information processing | taiwan semiconductor |

Fundsmith’s high holdings, it isn’t a nasty firm. In reality, they’re all world-class corporations. However a lot of them at the moment are as costly as Vanguard Funds’ Mag7 tech shares. watersFor instance, it trades at a price-to-earnings ratio (P/E) of roughly 28.

Nevertheless, I anticipate Vanguard Funds inventory to ship extra development within the brief time period. this 12 months, NvidiaWaters’ income is anticipated to develop 54%, whereas Waters is anticipated to develop 6%.

excessive charges

The third purpose I help Fundsmith is their pricing construction. All in all, it is too costly given the shortage of efficiency. At the moment, the annual price via Hargreaves Lansdown is 0.94%, whereas the Vanguard fund talked about above has an annual price of 0.19%.

I do not assume Smith and his workforce are doing sufficient to justify their excessive pay. If I will pay that price, I might wish to see higher stock-picking concepts.

The place did you place your cash?

As for the place we reallocated our capital, we put it into two completely different tracker funds. One is the aforementioned Vanguard Fund.

With this fund, you’ll be able to acquire publicity to over 3,600 completely different shares with very low charges. And the nice factor is that winners can maintain operating (like Nvidia has executed in recent times).

One other fund I used was Authorized and Common World 100 Index belief. It is a low-cost tracker that gives data on 100 of the world’s largest corporations.

It is value noting that these funds even have dangers. If the know-how sector melts down, the efficiency of those merchandise may endure.

However I am bullish in relation to know-how, so I am comfy with the danger (and consider the fund is value contemplating).

I wish to level out that I’ll return to Fundsmith sooner or later sooner or later. As I mentioned earlier, I like Smith’s high quality method. For now, I really feel there are higher investments on the market.