Picture supply: Getty Photos

tesla (NASDAQ:TSLA) inventory went public in July 2010. And anybody who purchased a large stake shortly thereafter (in 2011, for instance) would have made life-changing income over the subsequent 15 years.

Elon Musk’s enterprise made electrical automobiles (EVs) cool for the primary time. At the moment, the corporate has a market capitalization of $1.5 trillion, making it the world’s eighth largest firm. S&P500.

As compared, joby aviation (NYSE:JOBY) is a stickleback with a market capitalization of $12.4 billion. Nevertheless, I believe there are some similarities with the youthful Tesla.

So is shopping for Joby inventory in the present day at $13 like investing within the EV big a number of years in the past?

tesla within the sky

toyotaJoby Aviation, backed by Joby Aviation, is a US firm pioneering electrical vertical takeoff and touchdown (eVTOL) “flying taxis.” They’ll journey 160 miles on a single cost at speeds as much as 200 miles per hour in close to full silence, save for the rustling of leaves and wind.

Like Tesla’s EVs on the time, these eVTOLs are a play on the Inexperienced Revolution as a result of they fly with out the necessity for fossil fuels. This implies it has the potential to switch noisy and polluting helicopters, whereas additionally creating a completely new mode of transportation, which could possibly be extremely disruptive.

One other similarity is the corporate’s vertical integration. Just like Tesla, which makes its personal batteries and software program, Joby additionally designs and manufactures its personal electrical motors, propellers, and its personal ElevateOS software program.

Mr. Joby can also be eyeing markets outdoors of flying taxis, comparable to promoting the plane to 3rd events such because the U.S. navy and hospitals (for organ transport). This opens up aftermarket upkeep income alternatives.

Lastly, Joby goals to in the future fly autonomously (just like Tesla’s robotaxis). The corporate can also be creating hydrogen-electric know-how and has already accomplished a 523-mile check flight, with the one byproduct being water.

unproven mannequin

That being mentioned, I discovered that there are some vital variations. One is the sooner competitors. archer aviation in America and China vast. So it will not have a major marketplace for itself, which Tesla largely had within the early days.

Second, Tesla is primarily a product firm, whereas Joby is a providers firm. In different phrases, you should buy an EV, however (sadly) the probabilities of proudly owning an eVTOL are very low. This makes the enterprise mannequin a lot much less confirmed and doubles the chance for buyers.

remaining stage

Joby plans to launch a business air taxi service in Dubai in 2026, after flying greater than 9,000 miles in 2025. After that, maybe the USA will assist the shepherds. delta airways Passengers touring to and from worldwide airports.

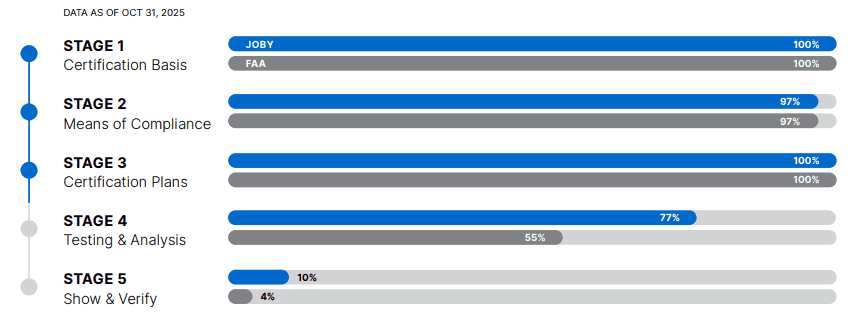

It’s presently within the remaining phases of certification by the FAA.

The corporate ended the third quarter with about $1 billion in money, however will virtually actually want extra cash to construct a whole lot of eVTOLs sooner or later.

Wall Avenue expects gross sales to achieve $570 million by 2028, a formidable 22 occasions larger than anticipated gross sales for a similar yr.

| root | Approximate journey time by automobile | Approximate eVTOL journey time |

|---|---|---|

| From Dubai Airport to Palm Jumeirah | 45 minutes (minimal) | 12 minutes |

| From JFK Airport to Manhattan | 50 minutes | 7 minutes |

| From Heathrow Airport to Canary Wharf | 80 minutes | 8 minutes |

| From Manchester Airport to Leeds | 60 minutes | quarter-hour |

Tesla subsequent?

I first bought Joby inventory in 2023 at $4.50 per share. Nevertheless, after the inventory value soared to almost $20 in August, I bought most of my holdings.

Nevertheless, I am holding the remaining shares as a result of Joby might develop into a Tesla-like winner sooner or later. And it may well additionally crash and burn (hopefully not actually).

Buyers on this speculative inventory, priced round $13, ought to know that it is rather excessive threat.