Picture supply: Getty Pictures

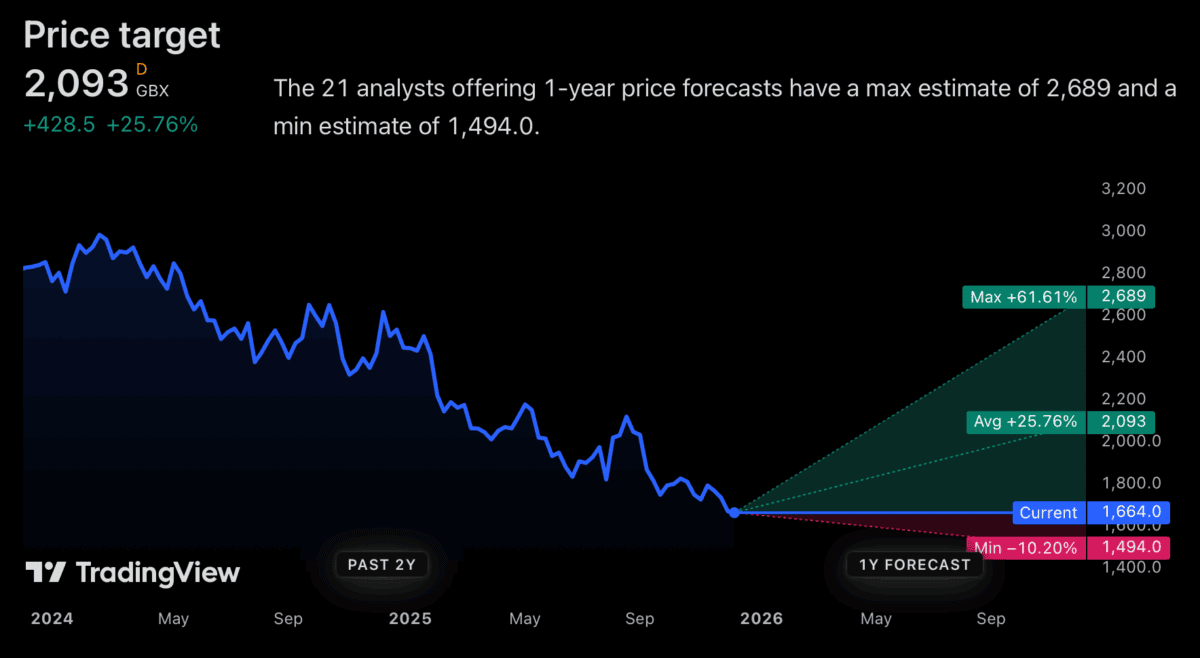

This 12 months, it is down 35%. diageo (LSE:DGE) share value anticipated to recuperate in 2026? Analysts are optimistic, however buyers needs to be cautious.

of FTSE100 The spirits firm has a brand new CEO who sees clear potential within the enterprise. However there are nonetheless some large challenges dealing with the corporate within the 12 months forward.

Analyst predictions

Typically talking, analysts’ value targets for Diageo over the following 12 months are fairly optimistic. So far as I can see the common is £20.93 or 25%. larger than the present inventory value.

It looks like 2026 shall be sufficient to make a revenue, however is it potential? Realistically, for the inventory to rise 25%, the corporate would want to return to income and revenue progress.

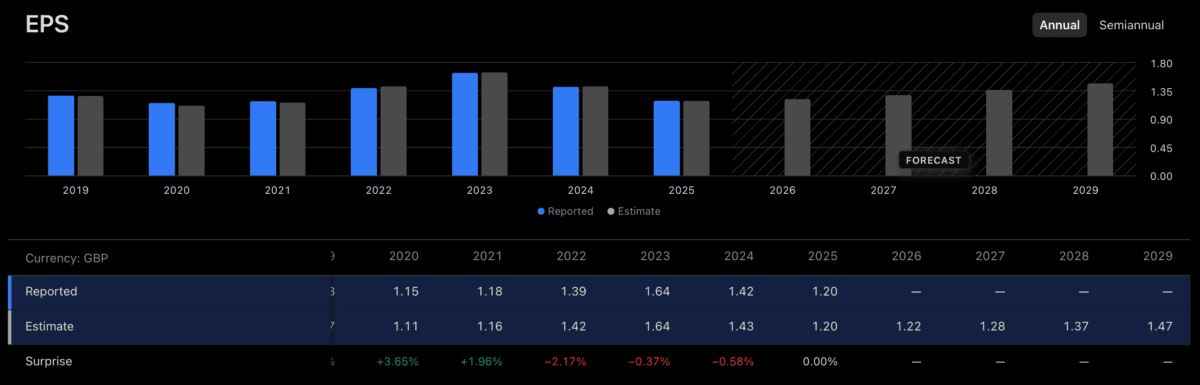

It’s price noting that analysts’ forecasts on this regard are fairly modest. Though 2025 is anticipated to be the underside, a return to 2023 ranges is just not anticipated any time quickly.

For 2026, analysts count on gross sales to rise 0.5% and earnings per share to rise 1%. And I am not satisfied that is sufficient to push the inventory value as much as close to £21.

progress challenges

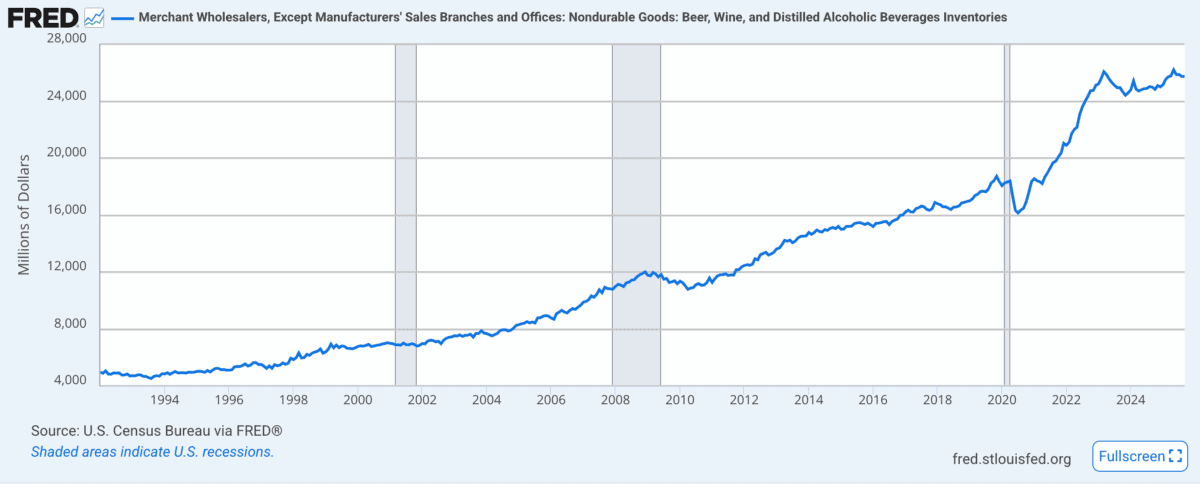

Considered one of Diageo’s largest issues is the current weak spot in demand in key markets similar to the US. And there may be motive to assume this will proceed into 2026. In the US, alcohol producers promote to wholesalers slightly than on to retailers. In consequence, wholesaler stock ranges generally is a helpful information level for buyers.

Supply: Federal Reserve Financial institution of St. Louis

On this regard, the scenario is just not very optimistic for Diageo. Excessive inventories (relative to gross sales) doubtless imply weak demand, and inventories are at present close to document ranges.

I feel this may very well be an enormous problem for FTSE 100 firms. That is why I am cautious of whether or not the corporate can obtain sufficient progress to maneuver the inventory value in 2026.

From 2026 onwards

I do not assume Diageo inventory will recuperate in 2026, however that will not matter to long-term buyers. In actual fact, it might be price contemplating as a shopping for alternative.

The corporate’s current issues have all been on the demand aspect, and there is not a lot the corporate can do about it. Nevertheless, its competitiveness stays sturdy.

Along with this, the brand new CEO has a powerful monitor document of reinvigorating struggling companies. That is another excuse why buyers wish to be affected person with inventory costs.

Diageo might not be capable of return to profitability in 2023 instantly, however it might not should be to be an excellent funding. At present costs, regular progress could also be sufficient.

long run funding

I do not assume Diageo is a inventory to think about for buyers seeking to make a transfer in 2026. However for buyers with a long-term outlook, the story could also be totally different.

An excellent funding is shopping for shares when they’re low cost. And that essentially means when others assume there’s one thing unsuitable with the underlying enterprise.

So may Diageo. Excessive stock ranges will proceed to be a problem subsequent 12 months, however the firm’s distinctive belongings imply the long-term equation could also be totally different.