Picture supply: Getty Pictures

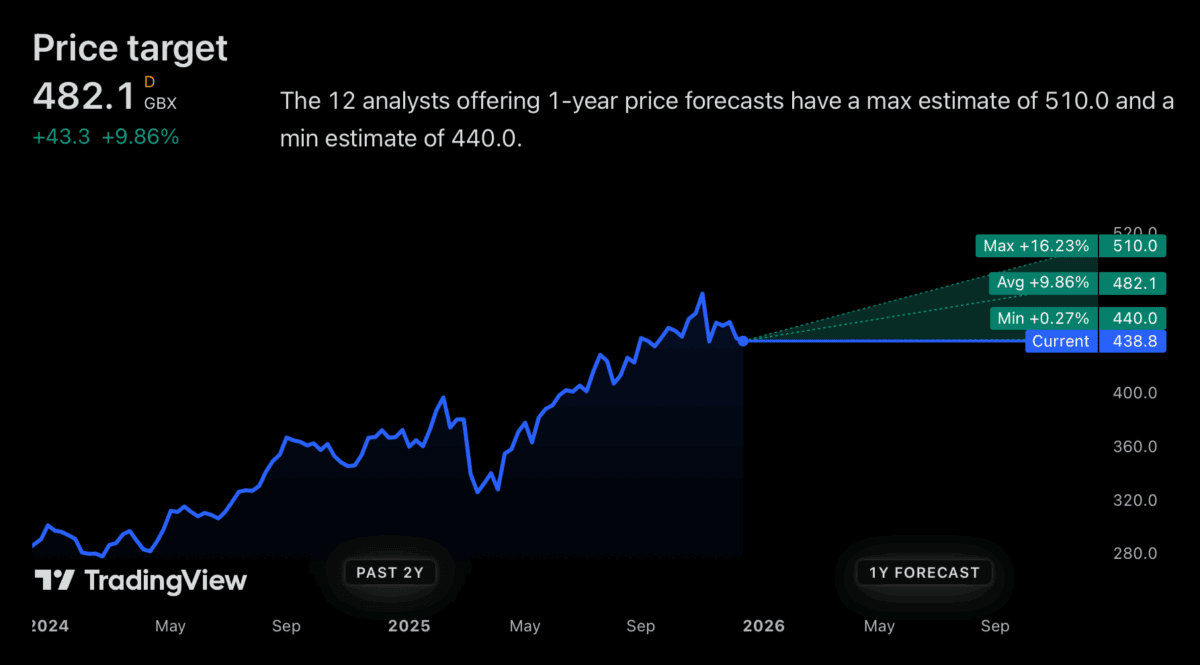

Analysts are fairly optimistic tesco (LSE:TSCO) inventory value in 2026. Though the worth goal is just not a lot increased than present ranges, nobody expects the inventory value to fall.

The important thing to investing within the inventory market is to reduce danger and keep away from losses as a lot as potential. So is it a no brainer for Tesco to spend money on the yr forward?

Analyst predictions

Analysts, apparently with out exception, anticipate Tesco shares to rise subsequent yr. That being mentioned, the ground value goal is lower than 1% increased than the present inventory value.

Mixed with the three.25% dividend yield, this is not a promising return for 2026, however it’s properly inside the worst-case state of affairs. Sadly it does not work that means.

Tesco’s share value may completely fall inside a yr. The obvious danger is the UK’s financial downturn, which may immediate households to chop again on spending.

However investing is all about what occurs within the subsequent 12 months. And from this attitude, there’s truly so much to love about Tesco.

grocery store

The grocery store business is a tough business for buyers. The largest drawback is that regardless of loyalty packages, prospects can simply change up the place they store every week.

Because of this no firm has a major capacity to successfully elevate costs. And because of this, earnings are low for nearly all operators, making them extremely weak to increased prices and theft.

The one actual benefit in an business the place prospects are value delicate comes from decrease prices than rivals. This enables for wider margins with out charging increased costs.

Regardless of the character of the grocery business, Tesco truly has a powerful place on this regard. That is why I believe British supermarkets are price contemplating as an funding.

aggressive benefit

Tesco’s benefit over different corporations is scale. With 2,965 shops, it has greater than double the variety of shops. sainsbury’s (1,478).

It is a huge benefit for 2 causes. Most clearly, a lot of shops means there are sometimes shops close by when shoppers are in search of comfort.

Bigger scale additionally places corporations in a greater place when negotiating with suppliers. To succeed in the widest buyer base, companies ought to undergo Tesco.

That is the primary motive why the corporate has been in a position to keep market share by competing with Aldi and Lidl on value. And this sort of sturdy aggressive benefit makes this inventory price contemplating.

funding technique

I do not suppose low costs will lose their enchantment to shoppers. However to ship worth, corporations want to have the ability to management their enter prices.

This isn’t straightforward within the grocery store business, the place switching prices are low, however Tesco’s dimension provides it a singular benefit over its rivals. And I believe that makes this inventory price contemplating.

We do not know what is going to occur to inventory costs in 2026. I do not know if it is “straightforward cash,” however I believe it is in a powerful place contemplating the dimensions of the corporate, and that is what I search for greater than something in an funding.