Picture supply: Getty Photographs

In response to the most recent information, financial institution of americaFund managers aiming to face out from the group in 2026 are eyeing UK equities. However ought to atypical buyers do the identical?

To get above-average returns within the inventory market, you’ll want to do one thing completely different. And it may very well be on the lookout for an undervalued alternative FTSE100 and FTSE250.

outperform the inventory market

Outperforming within the inventory market is tough, even for the very best buyers. Nevertheless, for individuals who merely purchase funds that observe an index, that chance is zero.

There’s nothing improper with getting common earnings. Traditionally, shares and shares have produced higher long-term returns than money and bonds, and that is no coincidence.

However for skilled fund managers, this isn’t a great factor. They should discover a option to carry out higher than common to justify charging charges for managing their prospects’ cash.

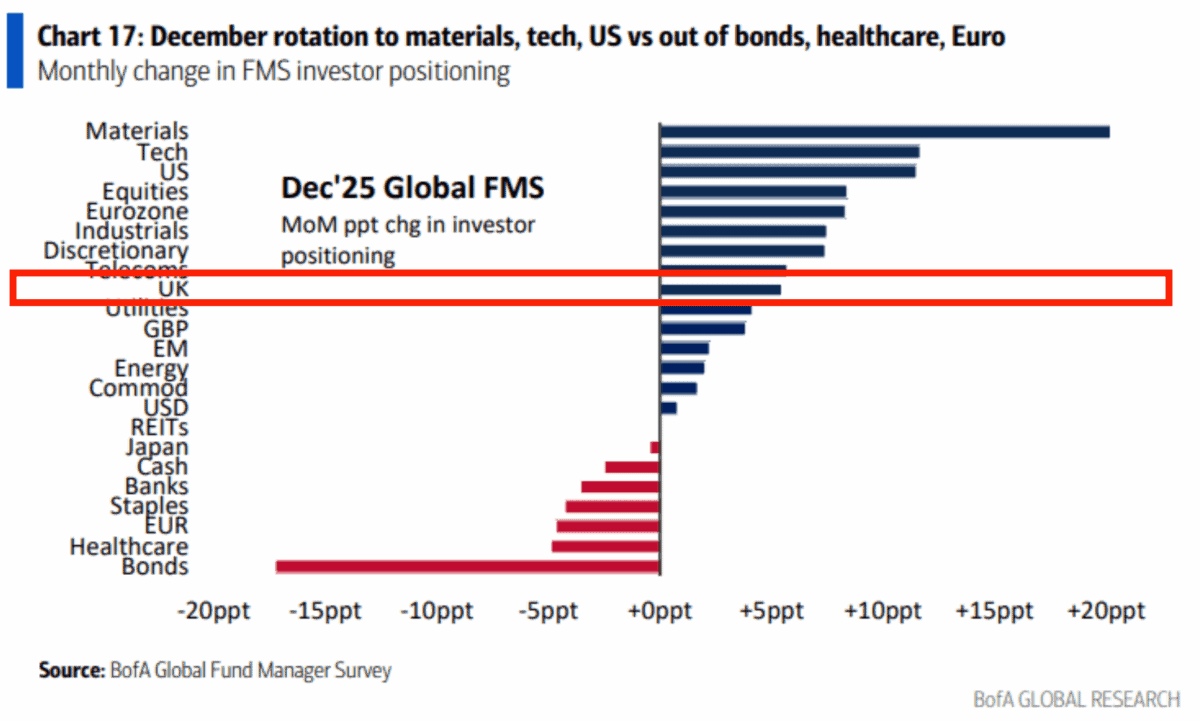

The Financial institution of America Fund Supervisor Survey is printed month-to-month. And it offers buyers attention-grabbing perception into what good cash is pondering and doing.

Chasing cash…

Know-how, supplies and US shares are the most well-liked shares for fund managers as 2026 approaches, based on the most recent information. Nevertheless, a choose few are keen on UK shares.

In different phrases, whereas UK shares are removed from a consensus alternative, a handful of buyers are betting on a possible alternative. And I feel that is price noting.

Sometimes, fund managers are required to report annual efficiency to their shoppers. So it turns into pure to assume by way of 12 month durations (and typically even shorter durations).

I am wanting additional forward in my investments. However even in such a scenario, there could also be shopping for alternatives now in UK shares that won’t exist on the finish of subsequent yr.

british values

Concerning contrarian pondering, JD Weatherspoon(LSE:JDW) is a UK inventory that I plan to carry for the long run. It has been a tricky yr for the hospitality trade, however the inventory is up 23%.

Not like many buyers, I feel the powerful surroundings could also be a part of the rationale. why The corporate is doing effectively. The corporate is seeing like-for-like gross sales enhance whereas opponents are closing venues.

That is an unconventional view, however I feel the largest threat is the federal government making an attempt to assist the hospitality trade. My sense is that it’s going to assist its opponents greater than JD Weatherspoon’s enterprise.

The corporate’s value benefit is because of its measurement and freehold property that cut back lease legal responsibility. And I am prepared to guess that is one thing that can proceed for a very long time to return.

do issues otherwise

Whether or not over the subsequent 12 months or 12 years, buyers can solely obtain above-average outcomes by doing one thing completely different. But it surely does not must be something drastic.

It may very well be so simple as pondering that UK shares are price greater than most buyers assume. And that appears to be the view of some fund managers for now.

JD Wetherspoon’s inventory outperformed in 2025, and I feel it may well carry out equally and even quicker over the long run.