Picture supply: Getty Pictures

Think about investing in Nvidia That is the inventory value again within the early days, when as we speak’s AI revolution was only a glimmer in CEO Jensen Huang’s eyes.

The corporate’s inventory market rise (up about 22,700% in 10 years) is known. And this has understandably sparked quite a lot of curiosity to find the subsequent Nvidia-type hidden gem.

That appears to be the hope of individuals on funding platforms. AJ Bell Anyway. As a result of, in keeping with information compiled by the corporate, the preferred shares purchased there up to now day (November twenty fourth) have been ITM energy (LSE:ITM).

Buying and selling at 72p and with a modest market capitalization of simply £449m, this inventory definitely nonetheless attracts the eye of many buyers as we speak. However now that it is up practically 200% since March, pleasure is rising.

Perhaps an enormous firm is on the best way?

Inexperienced hydrogen pioneer

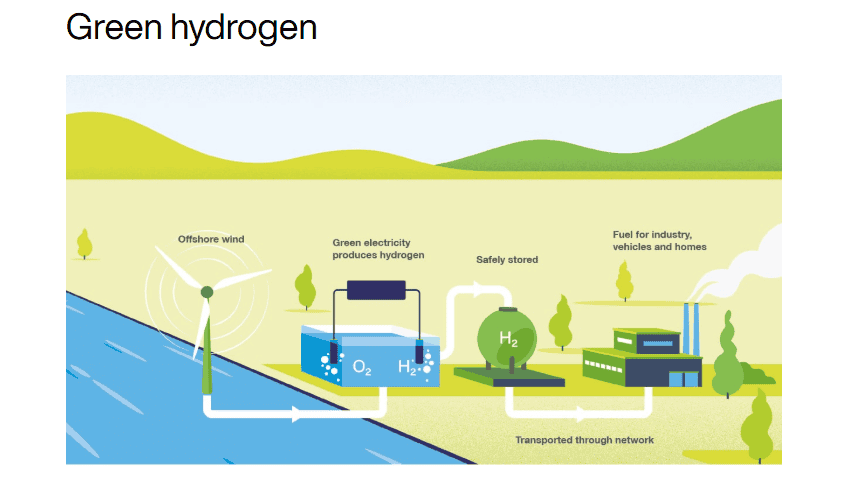

ITM Energy manufactures electrolyzers, industrial machines that use electrical energy to separate water into hydrogen and oxygen. As all of us discovered in chemistry class, water is 2 elements hydrogen and one half oxygen (H₂O).

Particularly, ITM will construct the gear wanted to supply inexperienced hydrogen that can be utilized as a clear gas for factories, vehicles, metal manufacturing, chemical vegetation, and vitality storage. The corporate’s NEPTUNE V items are the main containerization product for medium-sized inexperienced hydrogen initiatives.

Based on the 2020 report, goldman sachsthe worldwide inexperienced hydrogen market may attain €10 trillion by 2050. This 12 months, many international locations goal to attain internet zero.

Like Nvidia, ITM has important long-term progress potential.

Gross sales are rising

After 20 years in analysis and growth mode, the corporate is lastly beginning to see industrial success. Within the monetary 12 months ending April, ITM’s income elevated by greater than 50% to £26m.

In the meantime, its order backlog has elevated to greater than £145m, a rise of just about 90% year-on-year. Administration expects income to rise by one other 50% this 12 months (FY2026) to between £35m and £40m.

Trying additional forward, analysts anticipate the highest quantity to achieve round £78m by FY27. In different phrases, the corporate is presently experiencing important gross sales progress.

With accelerating market demand, a world-class product portfolio, a confirmed monitor report of execution, and a robust reference plant, ITM is well-positioned to steer the inexperienced hydrogen trade into its subsequent section of progress.. ITM energy.

pink ink

Nvidia is now probably the most worthwhile corporations on the planet, however ITM remains to be dropping cash. We anticipate an adjusted EBITDA lack of between £27m and £29m this 12 months.To replenish factories to extend price absorption and acknowledge income from conventional loss-making parts of contract backlogs.”.

That is the actual danger right here, as Citi’s analysts do not anticipate the deficit to go away for a while. The inventory can be buying and selling expensively at about 10 occasions estimated gross sales after hovering practically 200%.

The subsequent Nvidia?

However after I step again and give it some thought, I do not suppose this inventory has the potential that Nvidia has. In any case, manufacturing electrolyzers is a capital-intensive enterprise, whereas Nvidia is a capital-less chip designer (it outsources manufacturing). TSMC).

That stated, ITM is an attention-grabbing progress inventory that adventurous buyers would possibly wish to try at 72p. It has additionally fallen 89% since 2021.

Nevertheless, I’m presently specializing in different profitable alternatives within the inventory market.