Picture supply: Getty Photographs

granger (LSE:GRI) is a UK-listed actual property funding belief (REIT). The corporate’s share worth is £1.94, providing buyers a method to get onto the property ladder for lower than £2.

It is no secret that essentially the most tough a part of shopping for a house is elevating the deposit as costs proceed to rise. However I feel this might be a wise method to attempt to construct wealth to assist that course of.

constructing deposits

Making an attempt to save lots of up for a down fee to purchase a house could be a soul-destroying expertise, and everyone knows why. Regardless of rates of interest rising lately, actual property costs have continued to rise.

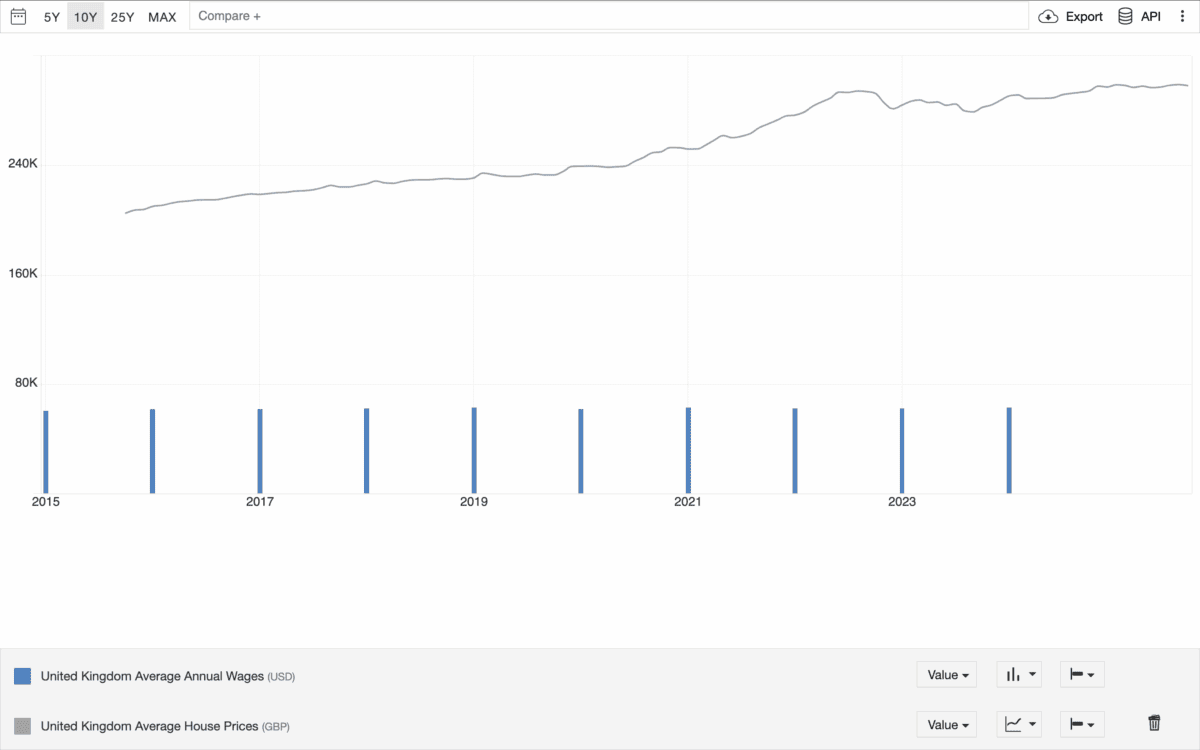

Over the previous decade, common home costs within the UK have risen by round 50% and common wages have risen by round 4%. neglect Netflixhealth club subscriptions, and many others., that equation simply would not work.

Supply: Commerce Economics

There are numerous theories as to why actual property costs proceed to rise, and I’ve one as nicely, however that is a subject for an additional day. What issues now’s what we do about it.

To keep away from being left behind, potential first-time patrons want one thing that can preserve them updated with rising residence costs. And I feel it is nicely price trying out Grainger as a possible reply.

ready-made portfolio

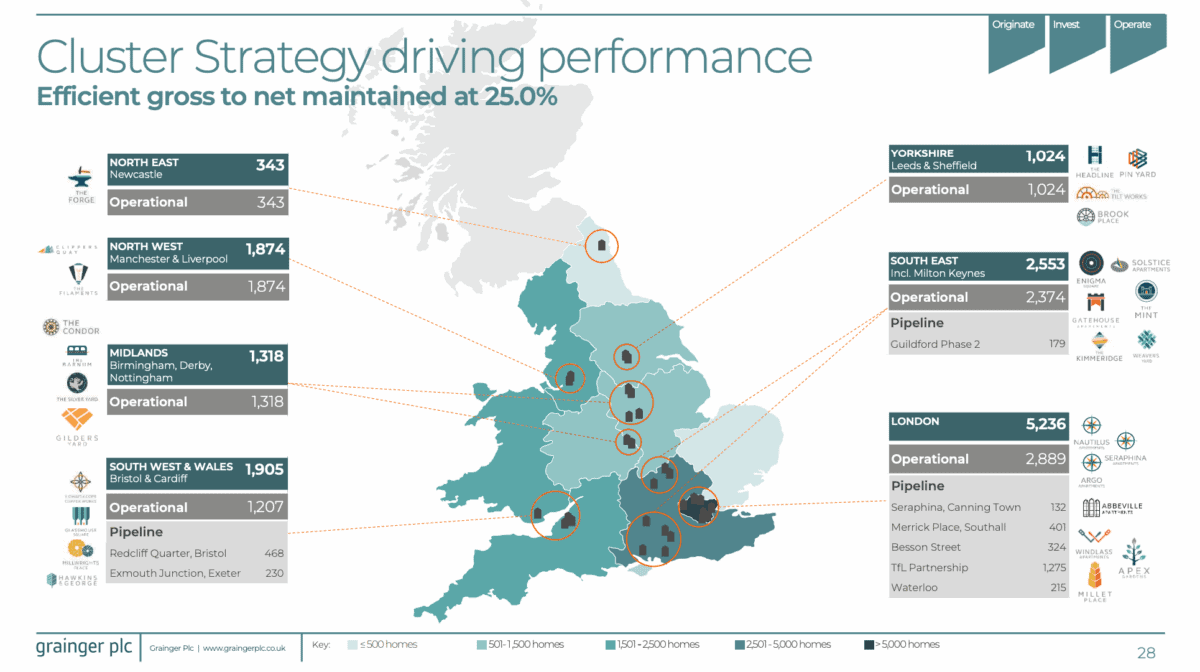

Grainger owns and leases a portfolio of over 11,000 houses throughout the UK. And about half of them are in London, the place demand at all times appears to be very sturdy.

Supply: Granger Investor Data

Merely put, it’s a kind of actual property funding. So, except one thing unusual occurs, your funding in firms ought to enhance as the worth of your portfolio will increase together with rising home costs.

There are a number of explanation why this isn’t the case. One is that if Grainger has to proceed renovating the constructing, the change in rental rules may end in vital unexpected prices.

However all else being equal, an funding within the firm ought to be capable of sustain with the rise in the actual property market. And we have not even gotten to what I feel is one of the best half.

rental revenue

As a REIT, Granger is obligated to return 90% of its taxable revenue to shareholders. Due to this fact, buyers not solely take part within the appreciation of actual property costs, but in addition earn money dividends from the enterprise.

Please word that tax therapy varies relying on every buyer’s particular person circumstances and should change sooner or later. The content material of this text is for informational functions solely. It isn’t meant to be, and doesn’t represent, any type of tax recommendation.

Dividends are by no means assured, however they’ve been steadily growing over the previous decade. And the corporate stories that lots of its tenants have a tendency to remain in its properties for lengthy durations of time.

Grainger additionally has large plans for future enlargement. A future pipeline price round £1.3bn means it goals so as to add an extra 37% to the worth of its present portfolio.

In a market the place costs solely appear to be going up, that might be an incredible worth. And buyers can take part on this progress by buying shares within the firm with out requiring a big down fee.

If we will not beat them…

It appears like first-time patrons within the UK are at a structural drawback, and have been lately. Nonetheless, investing in actual property by way of REITs is an thought price contemplating.

Proudly owning Grainger inventory may permit potential patrons to earn passive revenue on the facet and keep away from being left behind by rising residence costs. This is not the one alternative price contemplating.