Picture supply: Getty Pictures

A shares ISA permits Britons to contribute as much as £20,000 every year right into a tax-free funding portfolio. There’s nothing comparable by way of wealth creation within the UK.

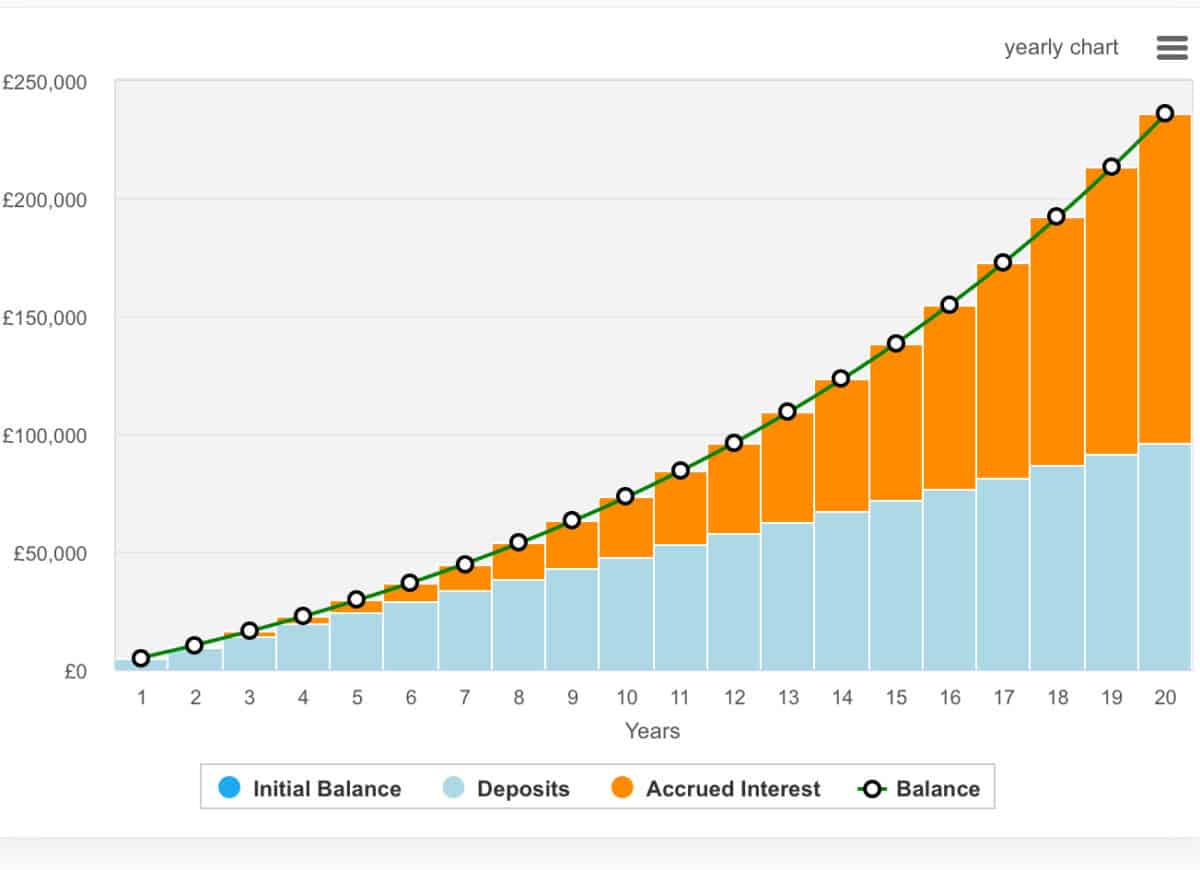

To generate £1,000 of passive earnings a month from a shares ISA (£12,000 a 12 months), an investor would wish a portfolio of round £240,000 with an annual yield of 5%.

It is a vital amount of cash, however the fantastic thing about composites means they do not must be constructed in a single day.

For instance, investing £400 every month in a decentralized ISA that offers you a median return of 8% per 12 months might develop to round £235,000 after 20 years.

Yearly, the returns themselves begin to turn into worthwhile, making it much more difficult. Early contributions develop over a long time, whereas subsequent contributions profit from an more and more bigger base.

It is not about timing, it is about consistency and time available in the market. Even modest common investments can snowball right into a significant supply of passive earnings, particularly if they’re shielded from tax inside an ISA.

Please word that tax remedy varies relying on every buyer’s particular person circumstances and should change sooner or later. The content material of this text is for informational functions solely. It isn’t meant to be, and doesn’t represent, any type of tax recommendation. Readers are chargeable for conducting their very own due diligence and acquiring skilled recommendation earlier than making any funding selections.

The place to take a position?

Okay, now that we have checked out how this may be achieved in principle, the following half is figuring out what to do to get there. After opening a shares ISA with a brokerage, traders want to decide on which shares to purchase with their hard-earned money.

Relying on the brokerage agency, the choices are normally huge. There’s every little thing from funds and trusts to shares and bonds.

Funds and funding trusts are managed by professionals who accumulate cash from many traders to buy various belongings and purpose to generate secure income.

These are thought of a simple option to unfold your threat with out choosing particular person shares. Shares, alternatively, characterize possession in a selected firm and are riskier, however can probably yield larger returns in the long term.

Bonds are basically loans to governments and companies that pay a hard and fast rate of interest, offering stability and predictable earnings.

Personally, as an skilled investor, my portfolio covers a variety of shares. Our data-driven method sometimes permits us to attain returns that far exceed these of index-tracking funds.

present favourite

My solely funding for October is London Inventory Change Group (LSE:LSEG). In response to analyst consensus, London Inventory Change Group is presently thought of probably the most undervalued firm on the worldwide market. FTSE100.

The forecast suggests a 42% low cost to honest worth. Nevertheless, such estimates needs to be handled with warning as the standard of analyst protection varies. So why is it so underrated?

The London Inventory Change Group has a large financial moat and excessive margin companies, notably in information and analytics. Moreover, the corporate is buying and selling at a ahead P/E ratio of simply over 20 instances, whereas reaching double-digit revenue development.

Nevertheless, no stock is ideal. Danger stays. Competitors in information and analytics is intense, and the transition from legacy merchandise might scale back recurring income.

Nonetheless, for long-term traders, these dangers will be balanced out by the corporate’s diversified and extremely worthwhile companies. I feel it is undoubtedly a model price contemplating.