Picture Supply: Getty Photographs

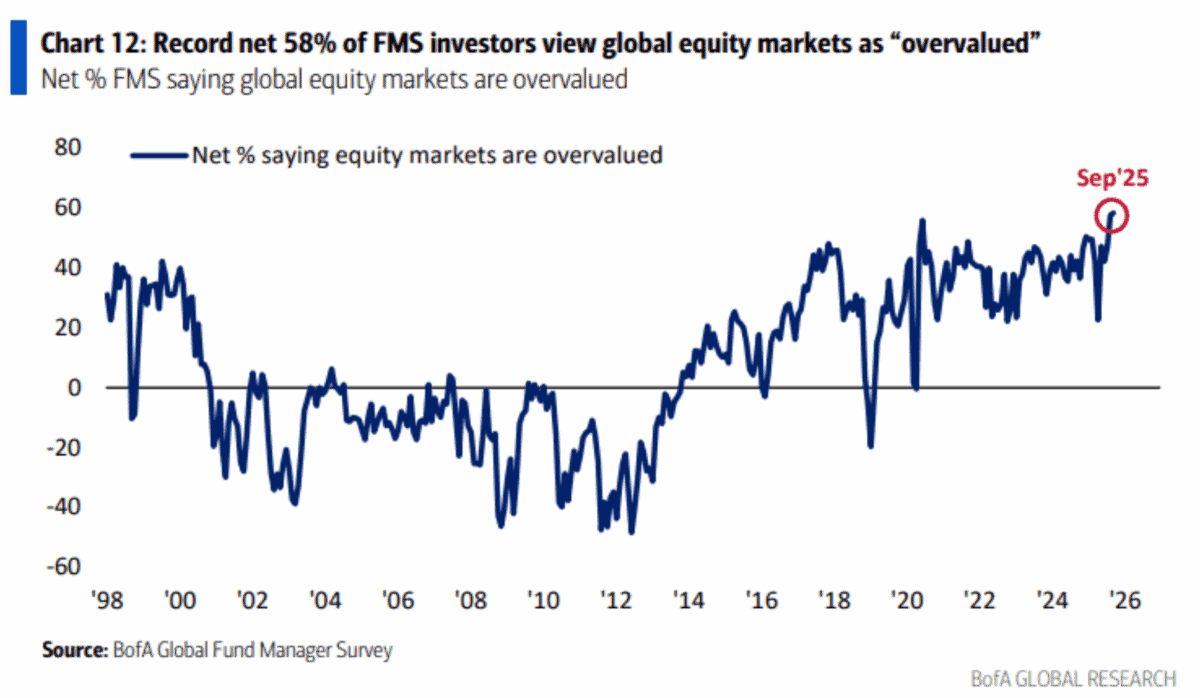

In accordance with the newest information from Financial institution of Americamost hedge fund managers consider that the worldwide inventory market is presently overvalued. And it has been a very long time since they felt this strongly about it.

Nevertheless, whereas not all shares are the identical, the vast majority of the market would not look costly at the moment. However the important thing for buyers is realizing the place to look.

Crowded trades

This 12 months’s main funding theme was synthetic intelligence (AI). And the obvious beneficiary of that is the gathering of shares often known as the “magnificent Seven.”

Within the second quarter of this 12 months, Magnificent Seven collectively made a revenue of 26.6%. In distinction, the remainder S&P 500 Managed income development fee of seven.4%.

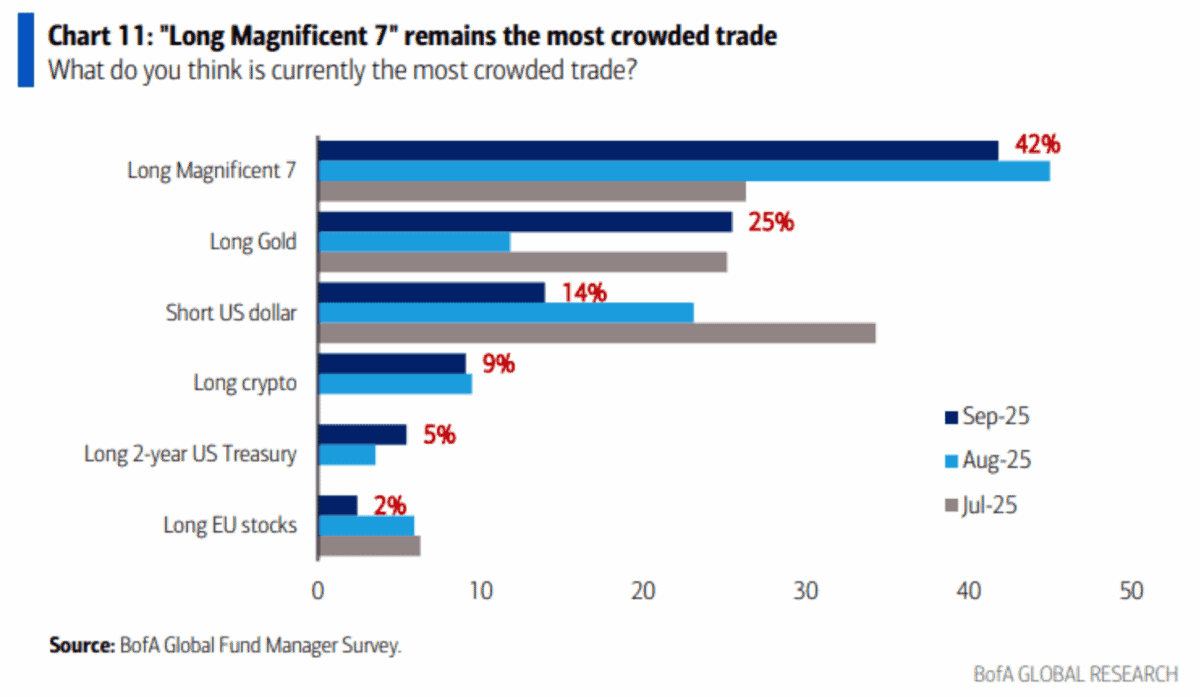

Such a development is of course attracting buyers’ consideration, particularly in comparison with the broader market. Nevertheless, fund managers are starting to suppose that transactions are busy.

Issues change into harmful when buyers begin doing the identical factor. Within the brief time period, it might result in a sudden return, however there are additionally long-term points to contemplate.

Warren Buffett

With regards to in search of alternatives that haven’t been ignored, Warren Buffett is without doubt one of the greatest issues within the enterprise. and Berkshire Hathaway CEOs have recommendation for buyers making an attempt to do the identical. “The long run is on no account clear. We pay very excessive costs within the inventory marketplace for hilarious consensus. Uncertainty is, in actual fact, a buddy of the client of long-term worth.”

In different phrases, buyers in search of long-term returns needs to be cautious of busy buying and selling. As a substitute, they need to search for alternatives in locations the place others will not be optimistic.

A few of these come to thoughts. Nevertheless, there are some issues I believe are price being attentive to at this level, particularly on the subject of the S&P 500.

Prescribed drugs

Danaher (NYSE:DHR) shares have fallen 30% over the previous 12 months. And modifications in well being coverage which have left the US administration away from remedy are dangers that buyers ought to take critically.

In consequence, gross sales have been declining, however the firm is starting to point out indicators of restoration. Earnings per share have been forward of expectations for each the primary two quarters of the 12 months.

Regardless of the difficult atmosphere, Danaher nonetheless has a robust aggressive edge based mostly on operational effectivity and wise acquisitions. And it is a promising long-term signal.

Supply: TradingView

Nevertheless, at this level, inventory costs are buying and selling at an unusually low degree on a ebook (P/B) foundation from value to ebook (P/B). In consequence, I believe it’s price contemplating as a possible buy alternative.

Discover a chance

I believe there’ll all the time be a chance to be discovered someplace within the inventory market. However as Warren Buffett factors out, these are normally not the place everybody else is in search of.

The rise of AI has introduced true development for a corporation often known as Magnificent Seven. However the deal is starting to get crowded, and that is one thing to be cautious for now.

On the opposite aspect, issues appear much less optimistic within the healthcare subject. Nevertheless, I believe that is the place buyers ought to look, as Danaher is starting to point out some optimistic indicators after a number of troublesome years.