Investors hope that the US job market will slow down with the right amount, causing fee cuts from the Federal Reserve in two weeks. It’s a move that could boost the economy, but not enough to cause a recession.

Wall Street’s major stock index gave up early profits on Friday after a report from the U.S. Labor Bureau said employers across the country hired far fewer workers than economists expected.

All major US stock indexes have been suffering losses, with S&P down more than 0.4% since 6pm in Europe, Dow Jones lost nearly 0.5%, and technology’s NASDAQ fell 0.17%.

Gold, one of the safe haven investments, has now grown by more than 1.2% at $3,651 per ounce.

The US dollar was lost against the euro, setting the rate at around 1.1757.

The European index has also changed courses and closed in negative territory. London’s FTSE 100 fell nearly 0.1%, Paris CAC 40 lost more than 0.3%, while Frankfurt’s DAX lost more than 0.7%.

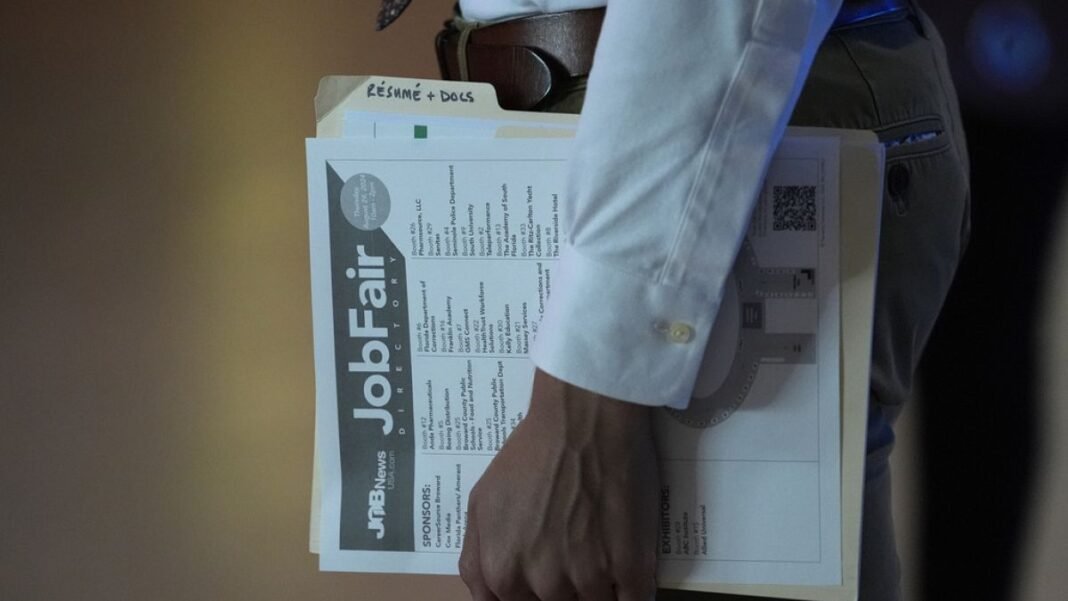

The US job market is slowing down

Total Non-Agricultural Pay Salary (NFP) – The name of the monthly report from the U.S. Bureau of Labor Statistics, which measures changes in the number of jobs, saw an increase of just 22,000 in August, fell significantly from the 79,000 revised 79,000 in July, far below estimates. Meanwhile, the unemployment rate rose slightly to 4.3%.

The US government also said earlier estimates in June and July exaggerated 21,000 jobs. Bond yields have fallen as investors responded to reports.

The unfortunate number continued last month Weaker updates than expectedCME Group data shows that traders are currently betting on the 100% chance that traders will cut key interest rates at their next meeting on September 17th.

“The market is priced at the Federal Reserve’s upcoming monetary policy conference with an interest rate cut of 0.25%, and a softer job count than today’s forecast may acknowledge that wish.

Such reductions can give the economy a kickstart; Job Markethowever, the Fed has kept them down so far this year as they can give them more fuel this year.

“Nevertheless, one major obstacle remains. Inflation continues to complicate the Fed’s path, and printing of the CPI (consumer price index) next week will be important,” Carter said, adding that US trade tariffs will lead to higher inflation, “which will lead to a split decision later this month.”

Until now, the Fed has been more concerned about the possibility that inflation could worsen due to President Donald Trump Customs More than the job market. However, the number of jobs on Friday was weak enough that they could even consider cutting deeper amounts in two weeks, said Brian Jacobsen, chief economist at Annex Wealth Management.

“This week was a story of slowing the labor market, and today’s data was the point of exclamation,” said Ellen Zentner, chief economic strategist at Morgan Stanley Wealth Management.

Job market data is disappointing, but it’s not so weak to scream for a recession yet. Investors’ hopes are that not only can the job market be balanced not strong enough to prevent interest rate cuts, but not weak enough to make the economy tumble.

Stocks have already been running on records recently. High expectations for future interest rate reductions.