Picture Supply: Getty Photos

Relating to constructing wealth between generations, few instruments are as highly effective or undervalued as the standard self-investment private pension (SIPP).

My household and I’ve put £320 a month in SIPP for my daughter, beginning with delivery (together with £80 with authorities tax credit score), aiming for a low double digit return in the long term. Is that doable? Solely time can inform, however to date we have now exceeded expectations.

Please word that tax procedures rely on every shopper’s particular person circumstances and should change sooner or later. The content material on this article is for informational functions solely. It isn’t a type of tax recommendation or constitutes. Readers are liable for finishing up their very own due diligence and acquiring skilled recommendation earlier than making funding selections.

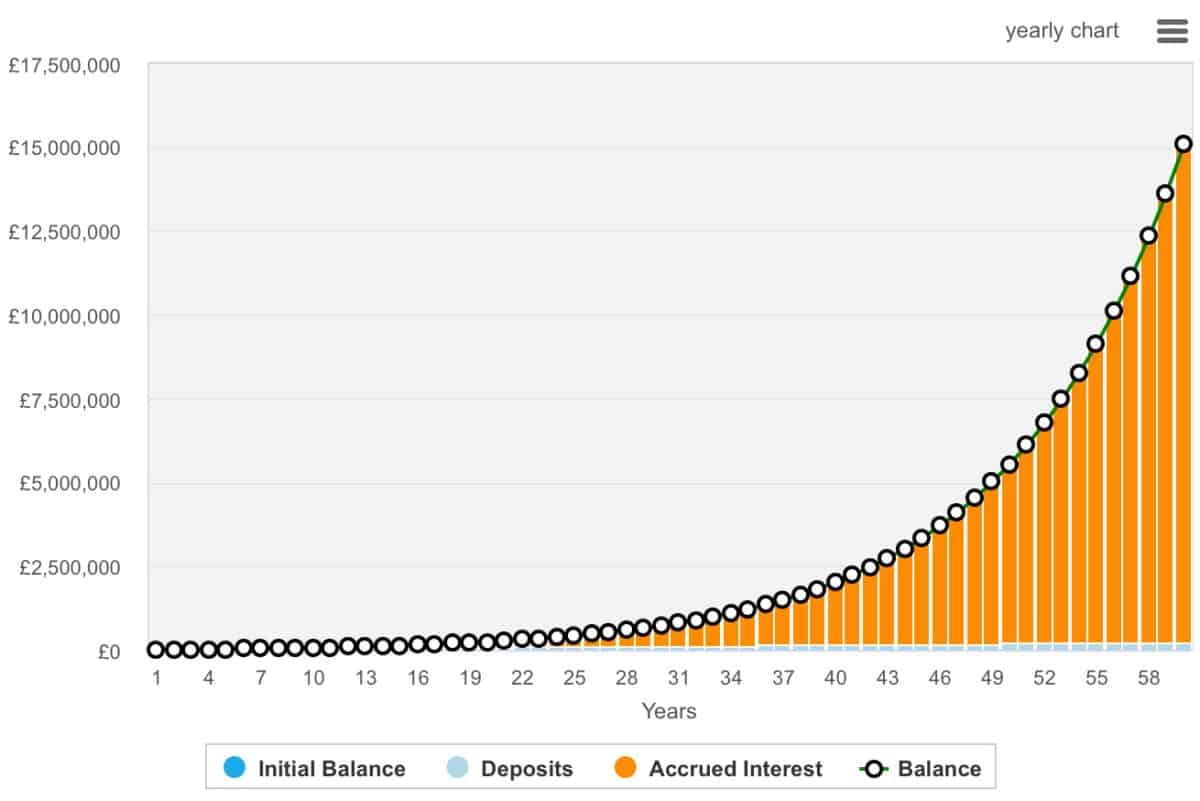

Nonetheless, if she achieves a ten% annual return in the long run (believable for long-term inventory market investments), her pot may exceed £15 million by the point she turns 60.

Even with a extra modest 8% return, we’re speaking about £5.7 million.

How does this occur?

Because the graph above exhibits, sediment stays negligible over the course of 60 years in comparison with the curiosity earned. That’s the magic of compound progress. Early on, earnings had been modest. Curiosity of simply £143 or £180 within the first yr, relying on 8% or 10% progress.

However over time they snowball. By the thirtieth yr, the ten% return mannequin will generate over £68,000 in annual curiosity. By the fiftieth yr, it should bounce to 525,000 kilos. This mixed impact is sometimes called “curiosity on curiosity,” and is a power that each one traders ought to purpose to take advantage of.

Getting began early is admittedly useful. Time out there beats market timing. Dad and mom or grandparents who begin this journey early can unleash exponential progress that late starters can’t realistically sustain.

After all, we can’t assure a return of 8% to 10%. Nonetheless, historical past suggests {that a} various portfolio of world fairness may provide simply that. For households searching for to speak lasting monetary safety, a baby’s SIPP might be one of many wisest presents ever given.

The place do you make investments?

When beginning SIPPs for kids, mother and father are inspired to think about a wide range of choices, from index monitoring funds to trusts and particular person shares.

One of many shares I believe I will proceed to love and value contemplating Melrose Trade (LSE:MRO). That is my largest holding – and for good cause. Administration goals to earnings progress of over 20% by 2029, however trades at a ahead P/E of simply 15.2, giving a worth of 0.75 to a income and progress ratio.

What excites me is that a big a part of this progress has already been embedded within the industrial aerospace cycle, with subsidiary GKNAEROSPACE offering long-term platforms akin to: Airbus and a320neo Boeing 737 Max.

These applications typically develop over a long time and supply dependable income streams. Melrose can also be very cash-generated. This yr alone, it’s anticipated to return greater than £600 million in free money stream.

Dangers embrace provide chain disruptions which were devastating the business for a while. Nonetheless, there are definitely some indications that we’re experiencing the worst.