Picture supply: Getty Pictures

A thick month-to-month wage with out work sounds nice. However realistically, £480,000 invested within the inventory market is required to earn, for instance, £2,000 a month as your second earnings. It’s constructed on possession of a portfolio that invests in shares or bonds that collectively provide a 5% yield.

After all, until absolutely deliberate, these shares are unlikely to truly ship £2,000 a month. Shares often pay dividends one or two instances a 12 months. This might imply that traders will obtain extra inside just a few months.

Nonetheless, the trail to reaching £24,000 a 12 months is practical. It isn’t a part of a wealthy Fast scheme. This takes time and endurance.

Begin from scratch

So, what’s the method? Nicely, it requires traders to open shares by main UK brokerage firms and share the ISA. This half is straightforward. Subsequent, they have to decide to contribute repeatedly to this account. On this case, £500 a month is ideal.

Many inexperienced persons begin by investing in funds that attempt to monitor the efficiency of a inventory or a specific index world wide. That is undoubtedly the bottom threat technique to spend money on the inventory market.

Nonetheless, some traders might attempt to beat the market. And this might embody investments in additional selective inventory teams with potential or typically ignored valuations.

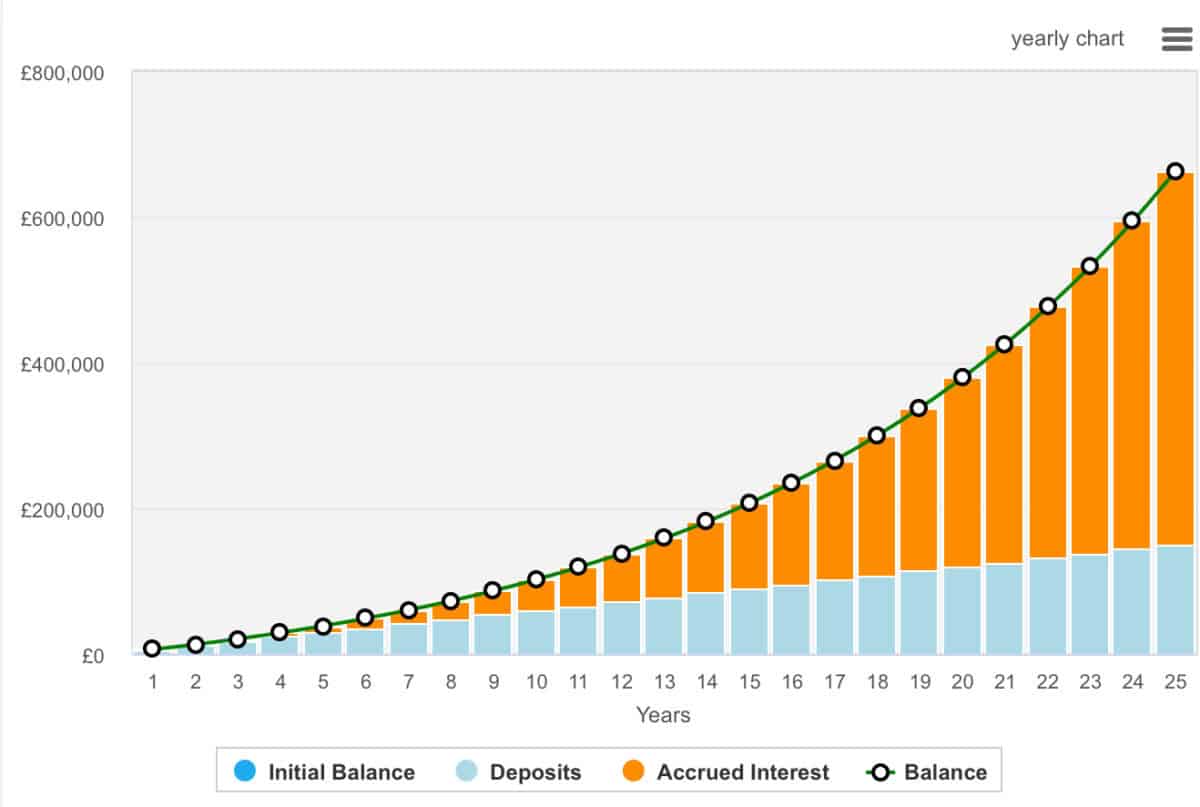

Skilled or educated traders can attempt to obtain 10% annual income. Utilizing this month-to-month contribution of £500, traders can flip their empty portfolios into £480,000 price of portfolios in additional than 22 years. This is the way it combines:

Moreover, all the pieces is tax-protected when achieved with shares and shared ISAs. There is no such thing as a capital beneficial properties to sluggish portfolio progress, and no earnings taxes to forestall dividends.

Buyers needs to be conscious that insufficient selections can cause them to lose cash.

Please be aware that tax procedures rely on every shopper’s particular person circumstances and will change sooner or later. The content material on this article is for informational functions solely. It isn’t a type of tax recommendation or constitutes. Readers are answerable for finishing up their very own due diligence and acquiring skilled recommendation earlier than making funding selections.

Make investments to win the market

Scotland mortgage funding trustsA UK-based mutual fund geared toward surpassing the market by specializing in high-growth firms world wide.

Managed by Baillie Gifford, the belief invests in disruptive industries similar to synthetic intelligence (AI), electrical autos (EVs), and digital platforms to pick companies that will restructure the sector.

This strategy contains each public equities and personal firms like SpaceX, with a versatile, long-term funding interval.

This belief can take a world perspective that’s not constrained by geography or sectors, and might help firms representing the way forward for trade wherever they’re. It has decreased publicity to China, however belief continues to speculate globally.

Nonetheless, traders needs to be conscious that the belief practices gearing (borrows investments). And whereas this helps belief construct a portfolio, it additionally will increase losses when the market is reversed.

However, its future look growth-oriented methods will help clarify its historic capabilities past international benchmarks. And this is the reason it’s the core a part of my and my daughter’s portfolio. I completely imagine it’s price contemplating.